UK pork production is set exceed 1 million tonnes for the first time since 1999 this year, but the market will remain difficult, according to the latest pork outlook from AHDB.

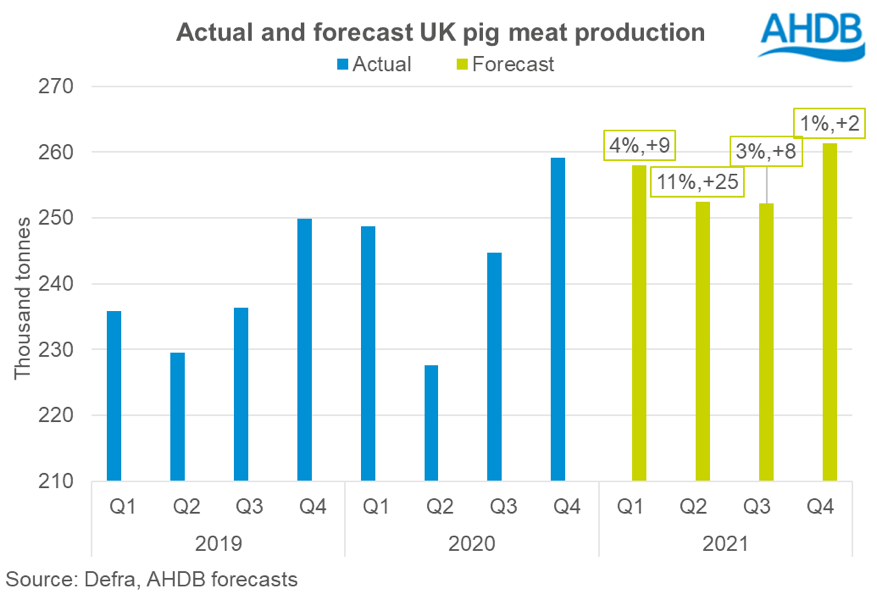

AHDB is forecasting a 4% rise in UK pig meat production to 1.02mt in 2021, driven by a 3% increase in slaughtering and a 1% increase in carcase weights.

With domestic demand expected to fall and high levels of uncertainty in the market, with plentiful EU supplies and difficult trading relations with the EU, pig prices are expected to remain under pressure, while declines are anticipated in both import and export volumes.

UK pigmeat production increased by 2.8% to reach 984,300 tonnes in 2020, driven mainly by higher carcase weights, which increased by 2kg, 2.5%, to average 86.9kg, well above the 5-year average and the highest level on record.

The upward trend is set to continue this year, particularly while the backlog of pigs due to COVID-19 issues in pork plants remains -carcase weights recently topped 90kg for the first time. Clean pig slaughter totalled 10.92m head in 2020, just 0.6% up on 2019.

Data indicates a small increase in the size of the breeding herd in 2020, but reports suggest little appetite to expand in 2021, due to the market uncertainty, AHDB analyst Felicity Rusk said.

AHDB expects the breeding herd to remain relatively stable, with clean pig throughputs forecast at 11.2m head, 3% up on 2020, driven by the slightly larger breeding herd, expected productivity improvements and the current backlog, with extra numbers likely to come through in the second quarter.

Uncertain market outlook

However, the uncertainty surrounding the number of pigs currently backed up, combined with questions over how slaughter capacity will function in the coming weeks, means there is more uncertainty than usual surrounding slaughter levels in the first half the year, Ms Rusk said.

Domestic pigmeat consumption, boosted by the switch towards retail sales during the pandemic, is estimated to have increased during 2020. But demand is expected to fall by 2% in 2021, as the expected recovery in the eating-out market will not compensate for the decline in retail volumes.

AHDB is forecasting that UK pig meat exports (excluding offal) will fall by around 7% this year due to a ‘more challenging’ EU market and lower Chinese demand.

The EU market, facing its own backlogs and export bans, is positioned to be well supplied in 2021 and there will additional costs for exports associated with leaving the customs union. The forecast assumes there will be an impact on EU export volumes during the first half of the year due to the disruption experienced at ports, although the extent and duration of this is uncertain.

As China rebuilds its pig herd, Chinese demand for imported pork is expected to decline by 10% in 2021, according to the USDA.

The combination of increased domestic supplies and lower exports is likely to contribute to lower demand for imported pork products – AHDB anticipates an 8% drop to 810,000t in 2021.

“The reality of a well-supplied European market could result in some pressure from cheaper EU pork. There may be some desire to replenish stocks with low-priced EU pork while it is available,” Ms Rusk added.