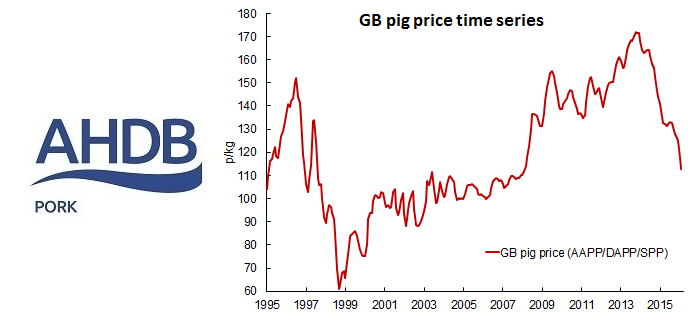

The future level of pig prices remains subject to “some uncertainty” according to the results of a new analysis by AHDB Pork which examined the relationship between pig prices and various influencing factors over the last 20 years.

Looking at how prices have moved since 1995 in response to such things as currency rate changes, import and export levels, oil prices, global food prices and so on, AHDB Pork’s initial conclusion was that pig prices really should have been better in January and February this year than has proved to be the case.

In seeking to explain the continued downturn, it is suggested that the weaker pound and firmer EU prices, at least in sterling terms, were to blame for keeping values lower than expected.

Equally, the hope of seeing some price recovery in the months ahead is tempered by an acceptance that there are still some major influencing factors which are inhibiting a return to better prices.

“There are instances in the past, for instance during the 2001 FMD outbreak and around the 1996 BSE scare, when the (price trend) model has temporarily broken down,” said AHDB Pork. “While there are clearly no disease issues of this kind at the moment, things such as the apparent reduction in consumer demand for fresh pork, the Russian import ban and the WHO/IARC report, could be contributing to the current lower than expected prices.

“If these extra factors are having an influence, they may fade, potentially allowing prices to recover. Beyond that, price developments will depend on how the factors influencing prices change.

“The key uncertainties are the pound-euro exchange rate and EU pig prices, as other major factors are more predictable. Political issues such as the result of the EU referendum and the length of the Russian ban will affect them, among other things. Therefore, there remains some uncertainty about the future level of pig prices.”