The latest EU pig slaughterings data from Eurostat confirms that UK pig meat production was rising towards the end of 2017 while the price of sows fell across the EU.

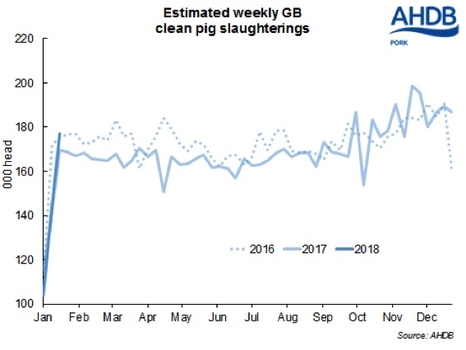

Throughputs for September and October totalled 43.7 million head, almost 2% higher compared to the same period a year earlier. Pig meat production grew slightly ahead of slaughterings across the months, recording an increase of over 2% year-on-year to nearly 4 million tonnes. This reflects a modest rise in carcase weights compared to 2016. The increased supply level will have no doubt been a key factor depressing pig prices both in the UK and on the continent during the autumn.

For the first 10 months of 2017, EU production therefore totalled 19.3 million tonnes. This is still almost 1% lower than the same period in 2016, due to tighter supplies earlier in the year. Slaughterings were also down just over 1% on 2016 levels, at 211 million head.

Further seasonal increases in production would be anticipated as the Christmas procurement period developed. Although, with EU pig prices remaining relatively flat during November, supplies seem to have been in line with demand for the time of year.

Production growth in Spain was a key driver of the overall increase in supplies, with volumes up 7% on the year during September/October as their industry continues to expand. Likewise, Poland also continues to record growth on the back of continuing investment, and volumes were up 6% on the year during the same period. A 5% increase in production was also recorded by France and Belgium. High pig prices in late 2016 and throughout 2017 will have aided industry expansion.

However, no growth was recorded by Europe’s largest pig meat producer, Germany, where volumes were stable on the year during September and October. Italy also bucked the trend and recorded a 7% year on year decline in output during the period.

Meanwhile EU sow prices have been on a downward trend for over six months, although markets were generally more stable in the latter quarter than they have been previously. Nonetheless, for the most recent week ending 14 January, the lowest prices since at least mid-2016 were recorded for most key European markets.

The fall in EU sow prices is reflective of the downward trend in the EU average pig reference price. This is characteristic for the New Year, with a slight rise in supply and diminished demand.

Since the week-ending 19 November the German M1 sow price has fallen by €0.08, to €1.04/100kg in the week-ended 14 January. This price is down 22% on the equivalent week last year and is the lowest price recorded since June 2016.

Dutch sow prices declined most significantly over the same period, down €0.12 to €0.97/100kg. French and Danish prices dropped too, but less remarkably. Over the last 8 weeks sow prices in both countries declined by €0.03, to be worth €0.78/100kg and €0.77/100kg respectively. Industry reports show similar downward pressure on UK sow prices.

In the latest week reference prices for clean pigs in Germany have started to stabilise. If this continues it is anticipated that sow prices would follow suit.