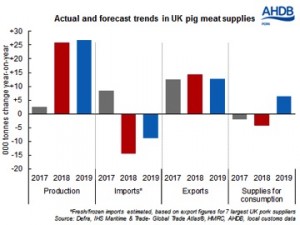

The latest AHDB forecasts for UK pig meat supplies indicate that the strong year-on-year growth in production recorded in Q1 this year is set to moderate. While domestic production is expected to remain above year earlier levels, disease challenges and slower productivity growth are projected to limit the extent of expansion.

Agrosoft data indicates an extra pig was weaned per sow during 2017. This is above previous expectations and the 5-year average increase, which is a gain of just under 0.5 pigs per year. However, this rate of improvement is not anticipated to remain at these exceptional levels, meaning the rate of slaughterings growth should start to slow as the year progresses. In addition, a number of reports have indicated that disease has been particularly challenging in the East and North regions from December and into Q1 this year, elevating post-weaning morality rates. Overall clean pig throughputs in 2018 are forecast 2% higher than 2017 levels, at around 10.7 million head. Some modest growth in carcase weights across the year means pig meat production is expected to reach around 930 thousand tonnes, 3% above last year.

So far, initial figures suggest imports have been behind 2017 levels, likely reflecting the high levels of domestic production recorded. As UK production is expected to continue year-on-year growth, albeit at a reduced rate, pig meat imports are also forecast lower throughout 2018. This is conditional on the success of EU pig meat exports outside the EU. Initial EU export signs are promising, with growth in shipments to South Korea and Japan, and further assistance may be anticipated if the US/China trade dispute continues. Nonetheless, with other key global exporters also expanding production this year, competition will be tough. UK export growth is anticipated to continue this year, reflecting an increased supply availability.

Taking these factors into account, it seems pig meat supplies on the domestic market should be broadly stable this year. However, uncertainty over the impact of disease on UK production, and conditions on the global market, threaten to upset this balance. In addition, retail sales have returned to a declining trend early this year, so domestic demand remains a challenge. All in all, it therefore looks unlikely 2018 will be as favourable for the British pork industry as the preceding year.