African Swine Fever has become a major issue within China since AHDB’s last update. Since the first confirmed case in August, incidences have increased and there are currently over 60 confirmed cases in the country. Until October ASF had been restricted to backyard or smaller farms however ASF has recently been confirmed at a large scale farm, which will fuel concerns that the spread of ASF in

China is far from over. ASF has now reached many of China’s pig producing regions, although culling of infected animals is still a small share of the total pig population in China. The Chinese government’s policy of imposing cross-border trading bans to affected regions is reportedly having an impact on production and pig supply throughout the country.

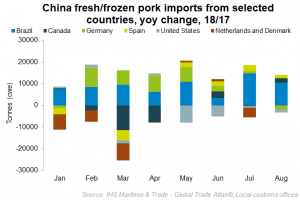

There has been no trade data published by China since March, therefore it is difficult to pinpoint how Chinese traders are reacting to the on-going threat presented by ASF. Nethertheless, looking at data from some of the leading exporters of pork to China can reveal some insight into current developments.

Up to August and July, depending on the reporting country, there has been a significant shift in trading volumes among the top exporters to China. In the year to August, Brazil and Germany have significantly increased volumes to China, with deliveries up 71,000 tonnes (+218%) and 30,000 tonnes (+35%) respectively compared to the previous year.

Brazilian pork heading into China is likely to have been made available as a result of market access into Russia being shut off throughout 2018. However, it was announced earlier this month that the ban by Russia had been lifted and Brazilian pork exports to the country may resume. This could therefore open up opportunities for other exporting countries with access into China towards the end of 2018.

Contrastingly, Chinese imports from the US and Canada are both down during the same period, the former undoubtedly due to the on-going trade war between China and the US and the additional tariffs that have been applied to pork. The Netherlands and Denmark, both significant exporters of pork to China, only have trade data available up to July. During this period both countries have recorded declines in volumes of fresh/frozen pork to China. Chinese imports as a whole appear to be growing, but only slightly (+1.5%) and based upon data up to July.

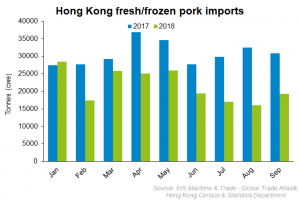

Neighbouring Hong Kong, which has published trade data up to September has recorded a 30% (-82,000 tonnes) decline in imports of fresh/frozen pork in the year to date. Imports from Brazil however, have grown strongly, and total 90,000 tonnes (+21%) while all other key trade partners have recorded a fall in delivered volumes, particularly the US (-56%) and Germany (-72%).

Domestic pig prices in China have been steadily rising since the low prices recorded in May, which were the lowest recorded in the last five years. Despite the steady rise, pig prices still remain below the previous five years for the time of year, and as of the week ending November 1, live hog prices were 14.03 CNY/kg (158p/kg).

The on-going trade war with the US is increasing the cost of pig feed in China, which is heavily reliant on US soya as a component. Going forward this could see producers limit expansion plans as cash flow becomes tight, and a heightened threat from ASF, increasing the opportunity for pork exporters to the region.