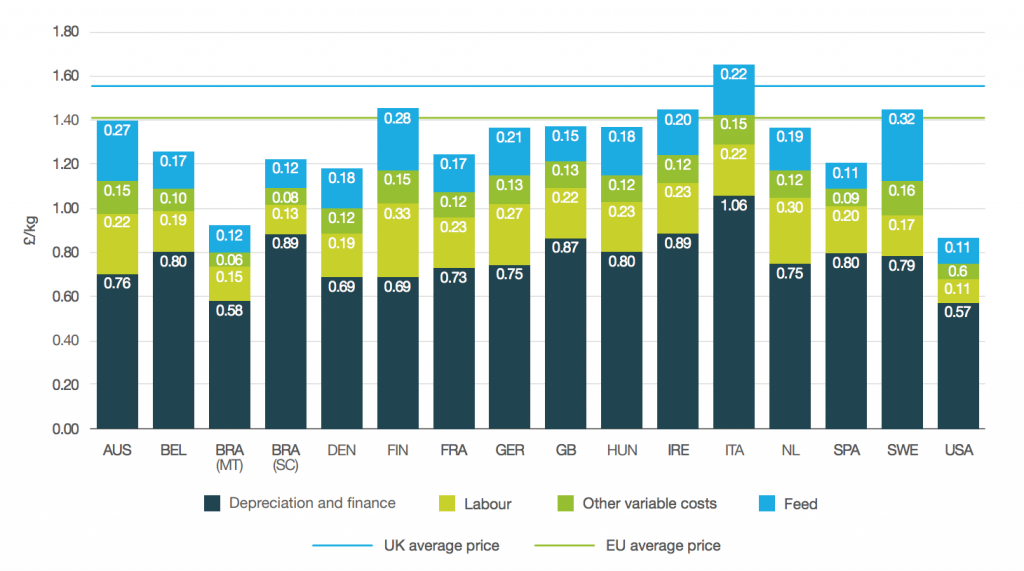

US pig producers, on average, produced pigs at an average cost of 50p/kg below the GB figure in 2017, according to the latest annual report from AHDB comparing pig production costs in different countries.

The cost of rearing pigs in Great Britain increased by 8% in 2017, to £1.37/kg. This was broadly in line with the average EU figure of £1.36/kg, a 7% increase in sterling terms compared with 2016.

However, within the EU, come countries were producing at significantly below the GB figure, including Denmark at £1.18/kg, Spain at £1.20/kg and France, £1.24/kg. At the other end of the scale, the Italian figure was £1.65/kg.

You can read the report here.

But, arguably, of even greater interest in the context of the ongoing debate about potential post-Brexit trade deals, the US 2017 cost figure was just 0.86p/kg, highlighting why there is such concern about the threat posed by cheaper imports produced to lower standards than permitted here.

The report showed the GB feed price increased by 16% in 2017, the highest by a distance of all countries covered in the report and more than double the average EU increase of 7%.

The average price for compound pig feed in the final quarter of 2017 had risen by £9 per tonne (4%) to £231 per tonne, compared with the last quarter of 2016.

The average price for compound pig feed in the final quarter of 2017 had risen by £9 per tonne (4%) to £231 per tonne, compared with the last quarter of 2016.

The biggest factor in the increase in costs in 2017 was feed price on the back of rising cereal and protein prices. Nearby UK feed wheat futures started the year at their highest level since January 2014, at £145.76 per tonne, 33% higher than a year previously, and although the eased later in the year, remained relatively high. Soya prices were also high.

The report also highlighted the variability in producer margins over the past few years as costs and pig prices have fluctuated.

The average UK reference price was 22% higher during 2017 than in 2016, averaging £1.56 per kg and 10% above the EU average of £1.41 per kg. This meant margins were positive throughout 2017, averaging £14/head, compared with negative margins in 2015 and 2016. The first two quarters of 2018 have seen average margins drop right back to £5/head in Q1 and £1/head in Q2.

The report also summarised previously published production figures, showing a 4% increase in pigs weaned per sow per year in Great Britain to 25.75 overall in 2017. Indoor sow production achieved 26.97 and outdoor sows 23.95.

The overall average number of pigs weaned per sow per year in the EU InterPIG countries increased by nearly 2% in 2017 to 27.79, with Denmark achieving 33, the Netherlands just over 30 and Belgium 29.8.

There was a difference of 8.5 pigs weaned per sow per year between the highest and lowest performing EU countries, with Italy averaging just 24.8.

GB produced nearly 2 tonnes of carcase meat per sow in 2017, 5% higher than in 2016, due to a combination of the increase in the number of pigs finished per sow and an increase in finishing weight.