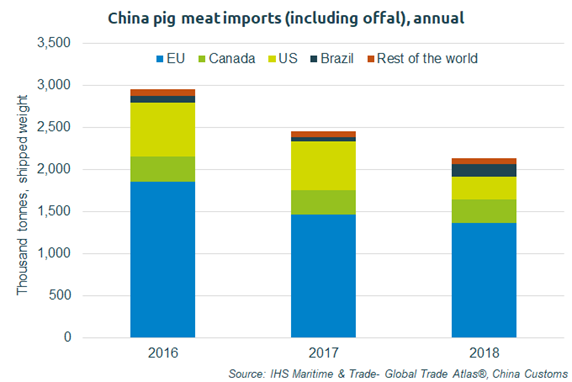

China imported 1.2 million tonnes of fresh/frozen pork, 24,000 tonnes (2%) less than in 2017, according to new figures from AHDB Pork.

In addition to this, 947,000 tonnes of pig offal was imported, down 290,000 tonnes (23%) year-on-year.

Rebecca Oborne, an analyst at AHDB Pork, said there was a switch in suppliers during 2018, with Germany overtaking Spain as the largest supplier of fresh/frozen pork.

Imports from Germany increased by 16,600 tonnes (8%) for the full 2018 calendar year, while shipments from Spain decreased 17,900 tonnes (8%).

This likely reflects the temporary disruption in access for some key German suppliers in early 2017. Imports from the UK recorded an increase of almost 4,000 tonnes, to total 50,000 tonnes during the year.

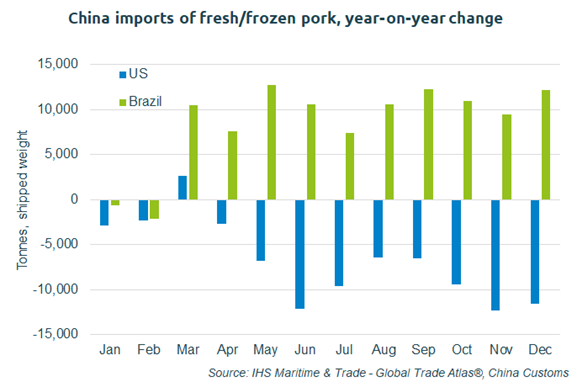

Fresh/frozen pork imports from the United States declined 80,000 tonnes (48%) year-on-year, reflecting the on-going trade war. US pork and offal face an additional 50% tariff on shipments to China, after China retaliated to US tariffs on Chinese steel and aluminium.

Ms Oborne said that China imported more than three times (+100,000 tonnes) as much pork from Brazil during 2018 compared to 2017, at 150,000 tonnes. This is related to the temporary closure of the Russian market to Brazilian pork.

The on-going trade war has seen Chinese offal imports decline significantly, primarily driven by the drop in US shipments. Historically, the US has been the main supplier of offal to China.

During 2018, Chinese imports of offal from the US decreased 240,000 tonnes (57%) year-on-year. Shipments from Denmark, Germany, Canada and Spain all also recorded declines, however, offal shipments from the UK remained steady.

Ms Oborne added: “Overall, the pressure faced by import volumes into China last year reflects both the trade war and low domestic prices early in the year. In more recent months, disruption to live transport in response to African Swine fever has driven pork prices higher in the south, reflecting a shortage of preferred fresh meat.

“However, it seems sufficient frozen meat supplies are still available from the Northern regions at present to prevent a rise in demand for imported product, which would also be frozen. Nonetheless, several organisations are forecasting a significant decline in Chinese pork production later this year, which is expected to offer some stimulation to import demand.”