Demand for pig meat in the EU has not been in step with supply levels in recent years, driving price volatility. Last year, there was more pork on the EU market but no clear increase in demand for this product, and so prices came under pressure.

Data for 2018, from key countries including Germany, France, Spain and Italy, provide further confirmation of this.

For France, the Kantar Worldpanel data for 2018 showed much lower fresh pork purchases (-4%) despite stable prices, indicating weakening demand. The market for ham and other charcuterie products is more important than fresh pork, but these volumes also fell 3%. However, this category did experience some price inflation that may have affected sales volumes. Pig meat was not the only category to record a decline, as both beef and lamb purchases fell compared to 2017. Even poultry purchases were lower.

Similarly, in Germany, there was a 3% decline in fresh and frozen pork purchases; although, some rise in price may have aggravated this (+1%). Meat sales were generally slow last year, according to AMI, influenced by the uncomfortably hot summer weather. However, pork did fare worse than other meats. Looking at poultry meat, higher retail prices (+3%) probably contributed to the 1% reduction in purchases. Household purchases of beef were also 2% lower, and demand for minced meat seemingly fell, given the 3% fall in volumes purchased.

AHDB analyst Bethan Wilkins said: “Full year data is not yet available for the key Southern European states. Reports from Italy indicate that household purchases of pig meat (year to September) declined nearly 1%, although higher prices meant market value still increased. Meanwhile, fresh pork sales in Spain fell nearly 2%, despite lower prices, in the year to October.

“However, processed meat did record a small (+1%) increase in volume and value.

It is important to remember that the above figures relate only to household purchases, and do not cover trends out of home. Nonetheless, it seems clear that demand across the meat categories was lacklustre last year.”

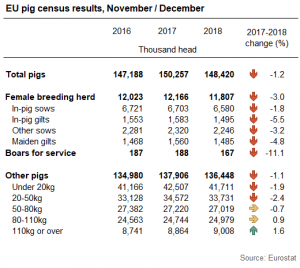

The overall EU pig herd decreased to 148 million head in the year to December 2018, according to provisional figures from Eurostat. Most of this decline was due to a 4% fall in the German pig herd, alongside 7% fewer pigs in Poland. Pig numbers also fell in Denmark, but to a lesser extent.

Hannah Clarke, AHDB’s trainee analyst, said: “The number of female breeding pigs declined by 360,000 head (almost 3%), with a particularly noticeable drop in pig gilts. Breeding sow herds in the majority of the biggest producing countries fell, with Poland recording the largest decline (-164,000 head) followed by the Netherlands (-96,000 head).

“Ongoing difficulties with African Swine Fever seem to have finally caught up with the Polish industry, which had nonetheless been expanding since 2015. The Netherlands also reported a marked decline in maiden gilts (-31,000 head), suggesting future numbers may be affected.”