The last time China needed to import large quantities of protein was in 2016, in response to its sow shortage. At that time, the protein shortage was met with imports of pig meat. In 2019, African Swine Fever (ASF) is expected to increase the demand for imported protein again.

This time, the scale of the expected production decline is much greater. Industry forecasts anticipate the protein deficiency in China will be anything from 10 to 20 million tonnes, depending on how much of the pig herd is lost to ASF and its management.

Even conservative estimates of the loss in production mean the volumes necessary to replace them are simply not available on the global market.

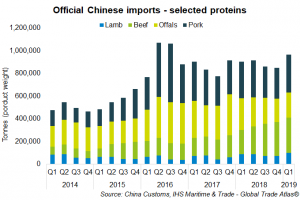

AHDB Pork’s lead analyst Duncan Wyatt said: “Demand for other imported proteins has already been growing in China, as Chinese consumers are increasingly familiar with these products. Chicken will play a vital role, although in 2016 China Customs reported imports of around 800,000 tonnes of beef and sheep meat; in 2018 this figure was 1.36 million tonnes.”

In the first quarter of 2019, imports of other proteins compared with a year earlier have increased by more than those of pig meat.

Mr Wyatt said: “Pork consumption is estimated to have declined between 10-15%, according to Rabobank. If pork prices start to rise in China, demand for other proteins could be further increased. Large volumes of frozen stocks of pork are being withdrawn and there is an increased level of pig slaughter, making more pork available domestically.”

Meanwhile, the trade war with the US is limiting overall increases in pork imports.

Mr Wyatt added: “These factors may be keeping the wolf from the door for now, and there is little question that global pork markets can be expected to receive a significant boost from increased Chinese buying. However, both imports and domestic production of other proteins will help fill the gap too.”