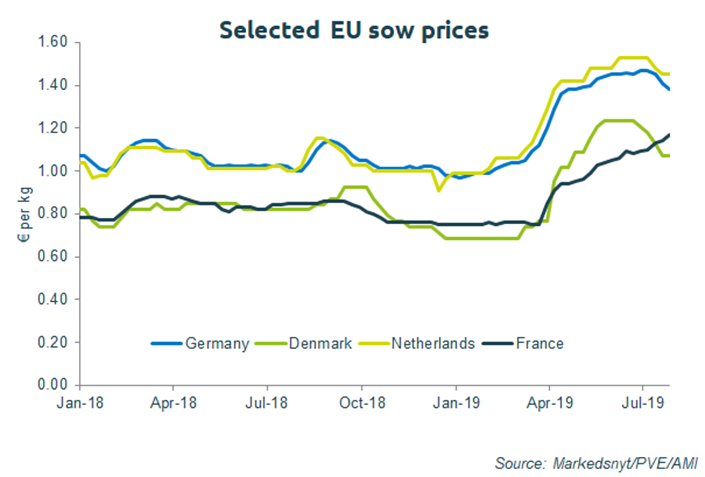

EU sow prices have risen significantly since the beginning of March, after a steady start to the year,. This reflects trends in the finished pig market. Both real and anticipated increases in Chinese import demand have been offering market support. Meanwhile, supplies of pig meat have tightened in Northern Europe in particular.

More recently, the EU pig market has been more tempered, with some declines over the past month. Therefore, sow prices have also started to fall. However, with further growth in Chinese demand expected, this may be a settling of a market rather than the start of a longer downward trend.

On an individual country basis, prices have showed the following trends since the start of 2019:

AHDB analyst Tom Forshaw said: “The UK exports many cull sow carcases to Germany, and the higher German sow prices will have boosted GB sow prices. This is supported by industry reports. The weakening pound will have also supported the competitiveness of UK sow meat on the EU market.

AHDB analyst Tom Forshaw said: “The UK exports many cull sow carcases to Germany, and the higher German sow prices will have boosted GB sow prices. This is supported by industry reports. The weakening pound will have also supported the competitiveness of UK sow meat on the EU market.

“The reliance on EU exports for UK cull sows means that in the event of a no-deal Brexit, it is likely that UK sow prices will be heavily affected. The implications of this were previously analysed here. Note that sow prices have risen since then, but will remain a relatively small portion of producer income.”