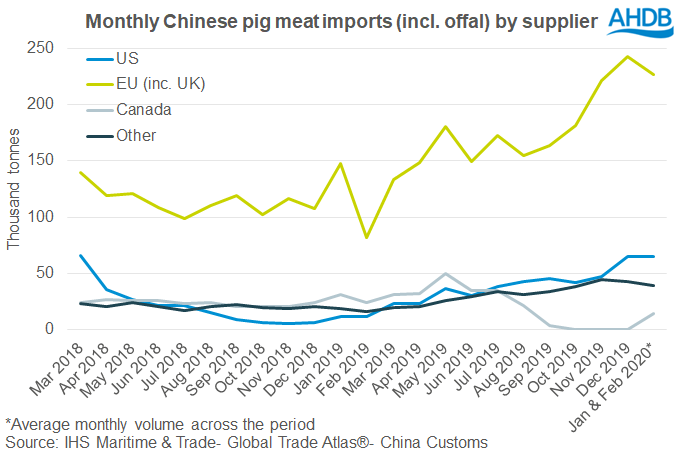

Across January and February 2020, China imported 691,000 tonnes of pig meat – twice as much pork and offal than in the same period last year, according to recently released combined import data from China Customs.

In the Chinese import figures, the peak in EU imports is in December, and the subsequent drop-off in volume is less noticeable, which AHDB analyst Bethan Wilkins says will ‘partly be due to shipping times and possible delays at ports on arrival’.

The US was the largest single-country supplier of pig meat and offal imports across January and February, supplying 19% of the total volume, with the surge seen in December remaining high into the new year.

AHDB’s Wilkins commented: “The US is hoping to continue increasing its presence on the Chinese pork market, with China agreeing to purchase more US agricultural products as part of the January trade deal.”

Imports of Canadian pork remained lower year-on-year in the most recent data, indicating that Canada has not yet been able to recapture market share even though the ban on imported Canadian pork was lifted in November.

The average price of the imported pig meat has continued to rise, reaching nearly 21RMB/kg in January-February.

“In sterling terms, this would be about £2.30/kg. To put this in context, the average price the UK paid for fresh/frozen pork imports in January was only a little higher than this, at about £2.40/kg,” Wilkins added.

“While trade with the Chinese market may have been disrupted somewhat recently, the ASF-induced pork shortage means strong market fundamentals remain. Though there are still logistical challenges to overcome, expectations of keen Chinese demand remain supportive of the pig market.”