Global pork production is expected to fall again in 2020, according to the latest outlook from the USDA, which has revised the figure downwards due to slower restocking than expected in China.

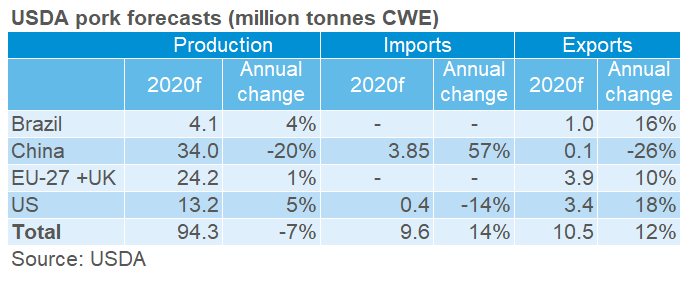

The 2020 estimate of 94.3 million tonnes is 7% down on the 2019 figure due to a lower output from nations affected by African Swine Fever (ASF).

And the latest estimate is 2% lower than the USDA’s previous forecast because Chinese production has been revised down by 6%, with the nation still struggling to recover from ASF, AHDB analyst Felicity Rusk said. The USDA now expects Chinese production in 2020 to be 20% lower than in 2019, which was itself down 21% from 2018.

“It is likely the outbreak of COVID-19 has only slowed progress in this area, based on reports from Rabobank and other agencies,” Ms Rusk said.

However, the key exporting nations, including the US, EU (including UK) and Brazil, are expecting to see growth in production this year.

“Strong export demand from Asian countries has provided producers with the incentive to expand herds. However, this is not enough to compensate for the decline expected in China and other nations affected by ASF,” Ms Rusk added.

With lower expectations of Chinese production, imports to China have been revised up 4% from the previous forecast to 3.85 million tonnes, almost 60% more than in 2019. In January and February alone, China imported twice as much pork and offal than in the same period last year.

But, overall, imports were revised down by 4% from the previous forecast to 9.6 million tonnes. Elsewhere, import estimates for many other nations, including Mexico, South Korea, Colombia and the US, have been revised down from the previous forecast.

“The COVID-19 pandemic has meant that the foodservice sector has all but closed in many nations. As such, demand from this sector has dissipated, which will have a knock-on effect on import demand. Furthermore, in the longer-term, weaker economic growth is also likely to affect import demand negatively,” Ms Rusk added.

Despite this, overall exports were revised up slightly (1%), driven mainly by an upwards revision to US exports.

“This is likely a reflection of the nation capitalising on the expected increased demand from the Chinese market” Ms Rusk added.