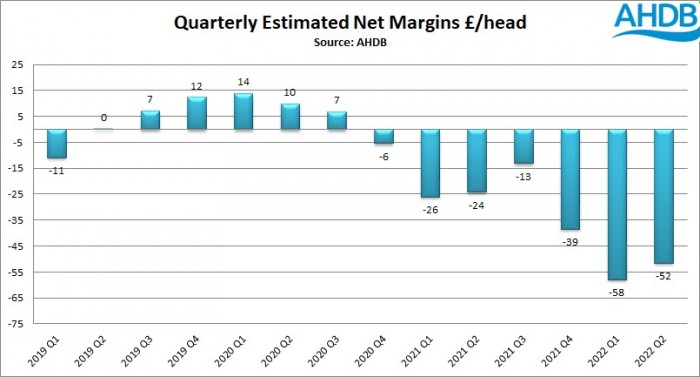

Average pig production losses have topped £50 per head for the second successive quarter, as soaring costs continue to cripple an industry that has now lost more than £600 million since the autumn of 2020, according to AHDB estimates.

The latest AHDB quarterly cost of production and margin estimations for Q2 show producers lost, on average, £52/pig (58p/kg) in Q2, following losses of £58/pig in Q1 and £39/pig in Q4 2021, meaning producers have now endured seven successive quarters of negative margins.

While the average pig price rose rapidly, from 146p/kg in Q1 to 183p/kg in Q2, so did average costs, as the impact of the Ukraine war on cereal prices hit home. COP averaged 240p/kg over the quarter, up 33p on Q1, 58p on Q2 2021 and 85p on Q2 2020.

While the average pig price rose rapidly, from 146p/kg in Q1 to 183p/kg in Q2, so did average costs, as the impact of the Ukraine war on cereal prices hit home. COP averaged 240p/kg over the quarter, up 33p on Q1, 58p on Q2 2021 and 85p on Q2 2020.

This was primarily driven by a further 27p hike in feed costs to 174p/kg, with labour, energy, fuel, interest rates and falling cull sow prices accounting for some of the other cost increases, with decreasing carcase weights also a factor.

The estimates use the latest performance figures for breeding and finishing herds for the 12 months ending June 30, 2022.

“With pig producers experiencing continued negative margins since October 2020, it is estimated (based on the total pig slaughter numbers) that the industry has lost over £600m since October 2020 to the end of June 2022,” AHDB analysts Carol Davis said.

The one slight ray of light is that spot compound feed prices have continued to ease slightly month on month since the May 2022 high, meaning average costs have come down slightly since Q2, averaging 231p/kg in July and 223p in August, according to the latest AHDB estimate. This assumes pig performance reflects Q2 figures, and also considers movement in energy, fuel and interest rates, as well as feed prices since then.

But with pig prices hovering around the 200p/kg mark, this still represents a continuing loss-making position for pig producers that has been ongoing for 22 months.

Numerous producers have already been forced to quit, and many more have reduced their sow herds, as reflected in the June Defra Agricultural Survey, which shows a 17% year-on-year decline in the breeding herd. This is expected to result in a large shortage over the late-autumn and winter.