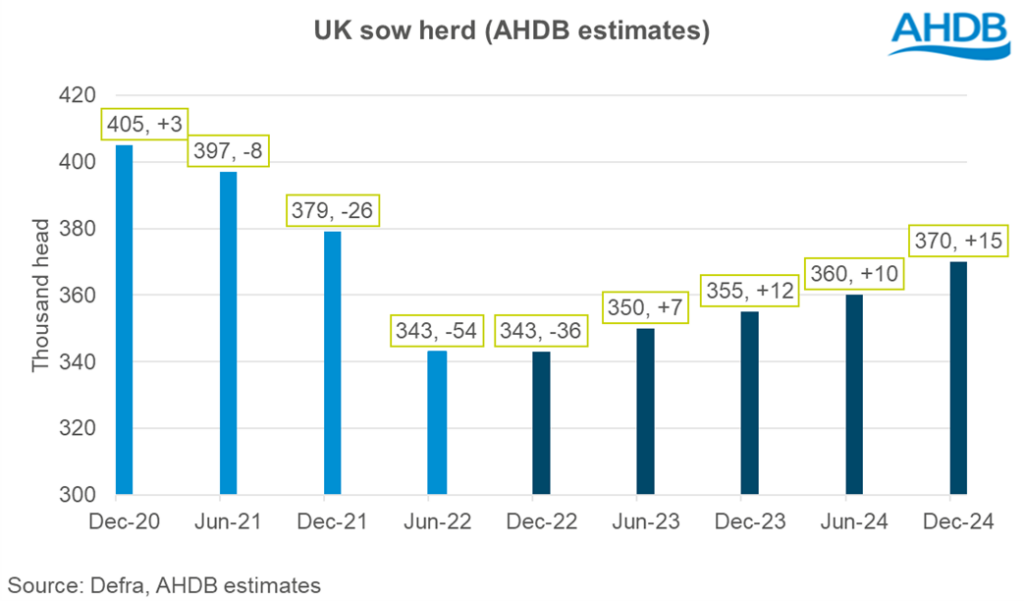

However, according to AHDB’s latest Pork Outlook a gradual recovery in the breeding herd is expected, with numbers predicted to increase by 7,000 head between June 2022 and June 2023.

As domestic supplies dwindle, imports are expected to grow to cover the deficit, while exports are projected to decline due to reduced availability.

Meanwhile, domestic demand for pork continues to ease, driven by the cost-of-living crisis reducing retail sales and eating-out demand.

Challenging year

The outlook report describes 2022 as ‘one of the most challenging years for the UK pork sector’, with continued negative farm margins resulting in a significant drop in the breeding herd, while war in Ukraine ‘added further fuel to the fire of increased input costs’.

Although the backlog of pigs seen at the beginning of the year appeared to have cleared by the summer, its legacy carried through the year with average carcase weights recording their highest value on record over the 12 months, driving production gains.

“As we head into 2023, the industry continues to face some tough challenges. The cost-of- living crisis both domestically and globally, input cost inflation and continual pressure from disease risks are to name but a few,” the report said.

With June census figures showing a sharp decline in the UK breeding herd and drops in the number of sows and gilts in pig/intended for breeding, is inevitable that there will be short supply of finished pigs in 2023.

“We forecast this is most likely to be in the first half of the year with some in industry suggesting we are already there/fast approaching that point. Looking to H2, recovery is likely to be slow through tentative producer attitudes alongside the knock-on effects of fertility issues brought on by last summer’s heatwave,” it adds.

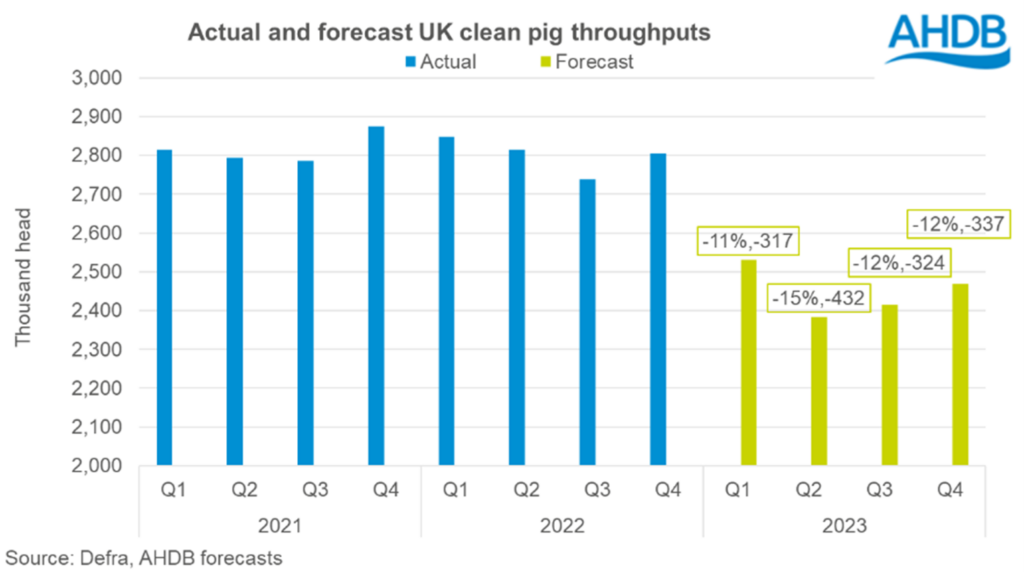

AHDB forecasts that the production of pig meat will decline 15% in 2023, ending the year at around 885,000 tonnes, driven mainly by a 13% reduction in clean pig kill, anticipated to total 9.8million head for the year, a loss of 1.4million head when compared to 2022.

Average carcase weights are also expected to be lower as pigs are brought forward sooner, with this forecast based on average finished pig carcase weights of 87kg.

The report predicts that the easing in input costs for the first time since late 2020, combined with the increase in pig prices, which have now moved well beyond £2/kg and are anticipated to remain historically high, will mean some producers ‘may start to feel a lift in the pressure on their farm margins’.

“This will likely encourage them to look further ahead to longer term investments and cautiously increasing head counts. Recovery in the population will be gradual and very much on an individual basis, remaining susceptible to any changes in input costs or prices paid,” it said.

On that basis, AHDB forecasts marginal growth in the breeding herd through 2023, but with numbers in June anticipated to be up only 7,000 head compared to June 2022. Longer-term, AHDB believes growth will steadily continue but will not return to numbers recorded in 2021 until at least 2025, if market conditions continue to support expansion.

Trade and demand

Imports of pig meat to the UK increased 11% year on year in volume terms in 2022 (Jan-Nov), almost returning to the pre pandemic volumes of 2019. AHDB predicts that imports will grow by a further 10% this year, partly to fill the hole in domestic production.

Exports of pig meat from the UK grew 7% year on year in volume terms in 2022 (Jan-Nov), again returning to pre pandemic levels. But exports are forecast to ease by 11% this year, as reduced production paired with a relatively small dip in domestic demand, forecast at 3%, will result in fewer supplies available.

Prices

The report is cautious on pig price, however. “In normal times, as supplies tighten it is reasonable to suggest that prices paid will increase – however times remain far from normal with the ongoing cost of living crisis impacting consumer confidence and spending,” it says.

“Assuming that prices hold steady and with inflation continuing to put pressure on margins, it will remain crucial for producers and processors to understand their cost of production and ensure they are working as efficiently as they can while negotiating the best possible contracts.

“Ultimately, consumers remain sensitive to accepting further price rises and therefore any price increases will have to be carefully considered as to not put consumers off purchasing pork products.”