Estimated April GB pig slaughterings were nearly 13% down on 2022 levels, as tight domestic supplies and high European prices continued to push the pig price up.

The total figure for the month (w/e Apr 8 – Apr 29), of just under 634,000 head was 93,100 head down from last April. Average weekly throughputs, at 158,500 head, were down 23,300 head compared to the same weeks last year.

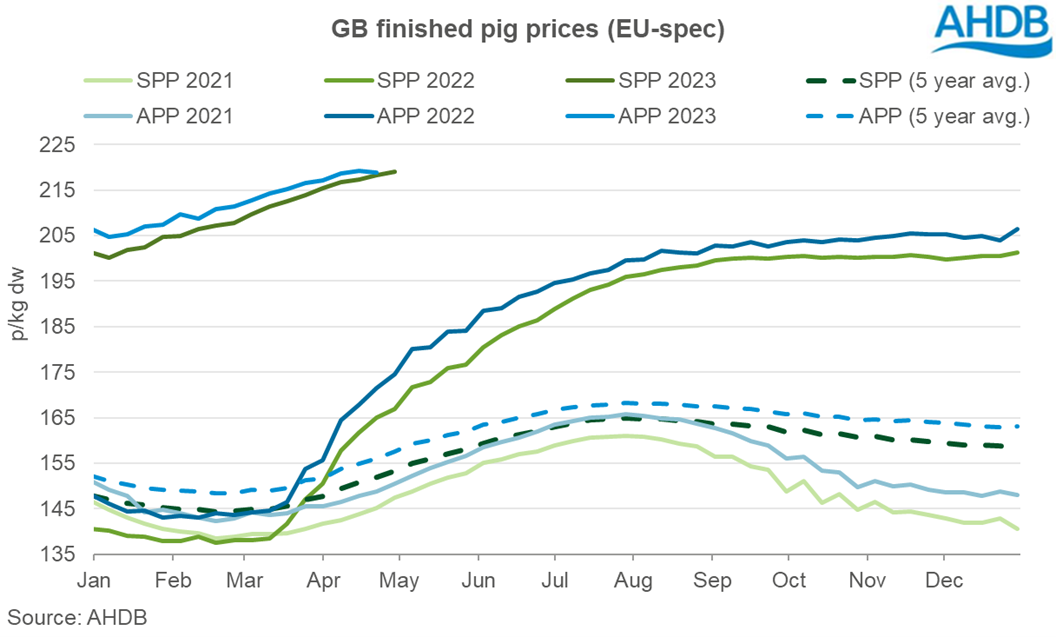

GB deadweight pig prices continued to rise during the month, the EU spec SPP ending it at 219.07p/kg, a new record high. This brought the monthly average to 217.8p/kg, with an average increase of 0.9p per week, ;slightly subdued compared to previous months’, according to AHDB analyst Isabel Shohet.

While it gained just under 3p over the four weeks of April, the EU spec SPP has gained nearly 19p over the 17 weeks since the start of the year.

The EU spec APP has seen similar gains, reaching a peak of 219.34p/kg in the week ending April 15, although the week ending April 22 saw a fall of -0.48p, down to 218.86p, the first fall recorded since the middle of February. This brought the average price for April to just under 219p/kg, with the gap between SPP and APP narrowing further to just 0.64p during the week ending April 22.

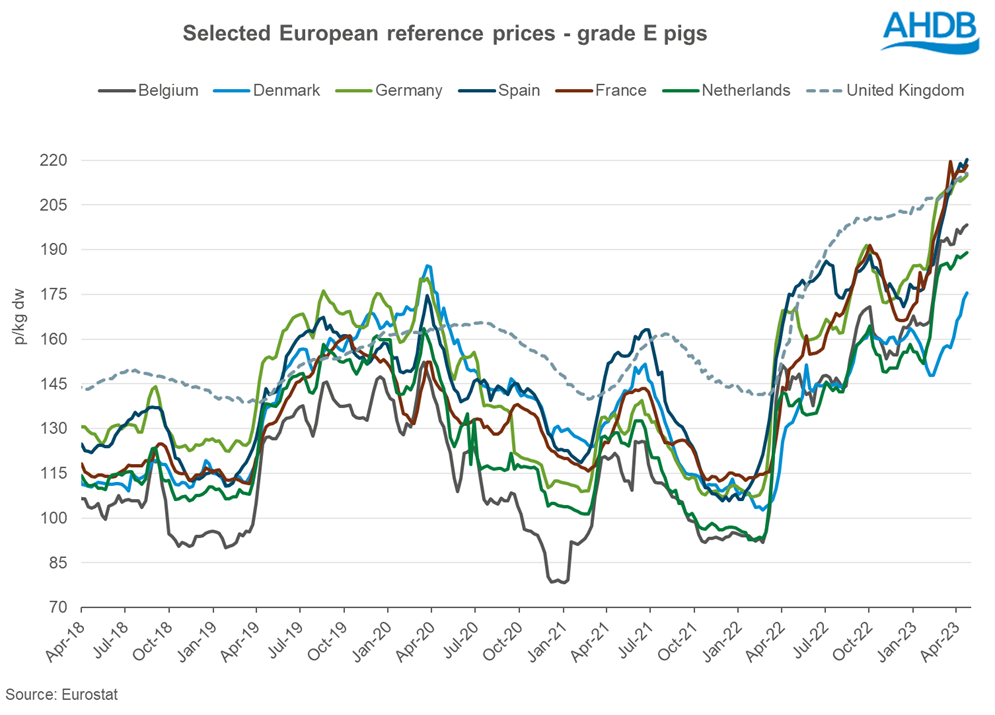

In Europe, prices continue to rise in much the same pattern as the UK, with the difference between the UK and EU reference price sitting at 4p/kg, a relatively small gap. The EU average reached an all-time high of 211.7p/kg for the week ending April 23, averaging 209p/kg for the four weeks w/e April 2 – April 23, gaining nearly 4p during this time.

In the 17 weeks since the beginning of the year, the EU average has gained nearly 32p/kg, with key producing countries such as Spain seeing price increases of over 43p, and France with growth of nearly 47p during this time frame.

Similarly, strong growth of between 30 – 33p has been recorded in Belgium, Germany, and the Netherlands. Meanwhile Denmark has seen increases of only 13p/kg following a period of falling prices in January.