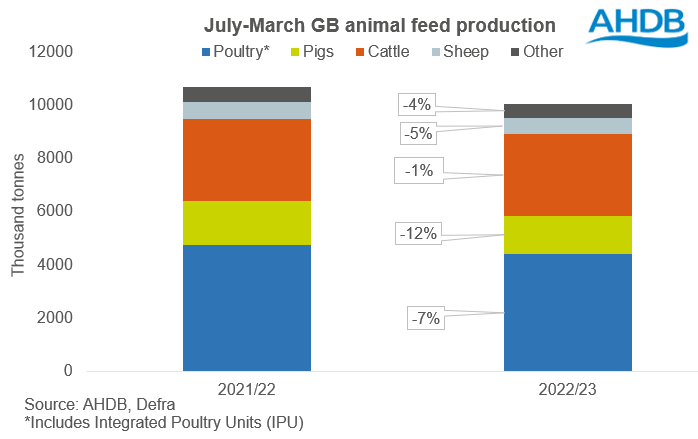

GB pig feed production was down 12% year-on-year over the period from July 2022 to March 2023, reflecting the significant contraction of the pig herd.

Production totalled 1.452Mt over the period, down 203,000t on the year and the lowest volume since 2018/19.

Total GB animal feed and integrated poultry unit (IPU) feed production continued to decline in March at 1.292Mt, down 8% year on year, according to data published by AHDB. The latest figure takes production for the first three quarters of the season (Jul-Mar) to 10.052Mt, down 6% on 2021/22 levels and the lowest level for this point since 2015/16.

Unsurprisingly, as has been the case for most of the season, the overall decline has been driven by a drop in monogastric feed. Poultry feed production was down 339Kt over the same period at 4.410Mt, the lowest level since 2014/15, while ruminant feed production (especially for dairy cows) is also down on the year, albeit by less, with margins continuing to be squeezed.

“Looking ahead, the poultry industry continues to struggle with higher energy costs, and inflationary pressure throughout the supply chain,” said AHDB analyst Millie Askew.

“Despite higher input costs, anecdotal reports suggest that wholesale carcass prices are coming down, squeezing margins further, with some producers leaving the industry all together.

“As it stands at the moment, it’s unlikely there will be any substantial recovery in poultry feed usage until at least midway through next season. While pig prices are continuing to increase, and margins are improving, the UK pig market is somewhat finely balanced.

“The current tight supply situation across the UK and EU is balanced against the long-term cost-of-living pressures impacting consumer demand. Going forward, there is expected to be a somewhat tentative recovery in the breeding herd next season. Therefore, we could see pig feed demand increase on this year’s levels next season, but not by substantial amounts.”

The drop in production inevitably equates to a fall in cereal usage. In the season to date (Jul-Mar), GB feed compounders have used 2.459Mt of wheat (-183Kt yoy), 896Kt of barley (-205Kt yoy), 58Kt of oats (-42Kt yoy) and 295Kt of maize(+11Kt). With animal feed production expected to continue to decline for the rest of the season at least, we can expect a continued reduction in cereal usage in rations, Ms Askew added.

“With a large surplus of wheat in the UK this season, if animal feed production declines further than already forecast for the rest of the season, we could see an even larger surplus. The next 2022/23 UK cereal supply and demand estimates are scheduled for release on 25 May and will include the latest usage and trade data as well as updated forecasts,” she said.