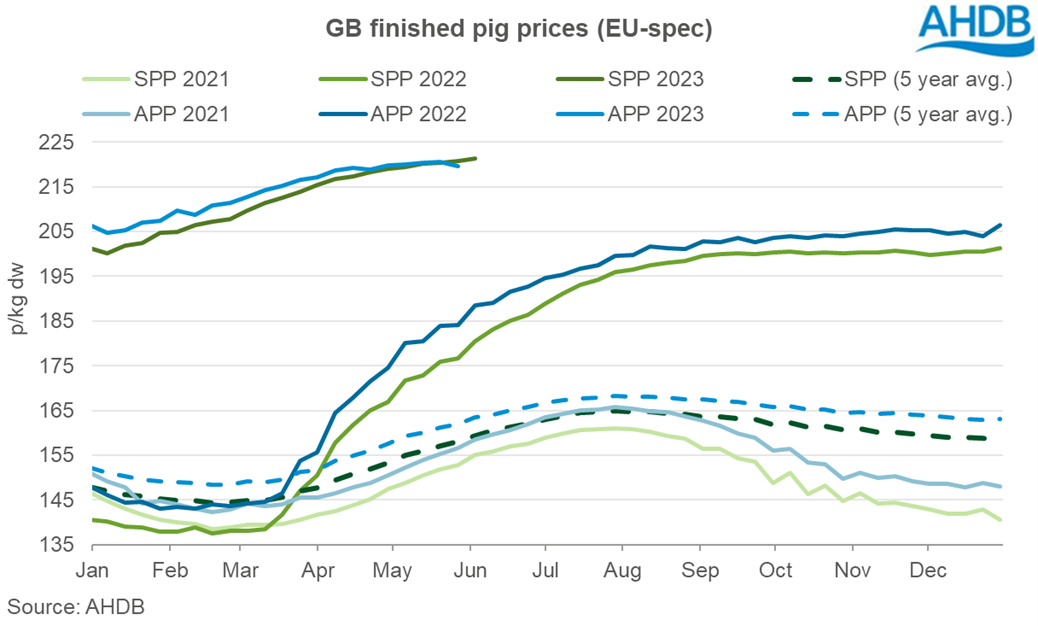

One of the most notable pig price trends in recent weeks has been the erosion, and now complete reversal, of the differential between the All Pig Price (APP), which includes ‘premium’ pigs, and the Standard Pig Price (SPP), which doesn’t.

Around a year ago, the gap was a record 8.5p and, at the start of this year, it was a more typical 5p. This has gradually come down this year until, during the week ended May 20, the APP, at 220.52p/kg was just 0.04p higher than the SPP.

The following week, ended May 27, saw the SPP move up again to 220.77p/kg, while the APP dropped back by nearly a penny to 219.54p/kg, leaving it 1.23p below the SPP.

This suggests ‘premium pigs’, such as outdoor bred free range are, on average, selling for lower prices than Red Tractor pigs.

AHDB said this was down to a ‘spectrum of influences’, including a tight marketplace, industry reports over contract commitments and consumer responses to food inflation and cost-of-living pressures.

AHDB’s lead analyst for red meat Tom Dracup said, after 18 months of ‘unprecedented volatility’, the wider market has repositioned since 2022.

“However, the marketplace continues to present its own challenges, with the domestic market continuing to witness substantial reductions in slaughterings and with the EU market remaining in the balance, the associated premium between the two-pricing series has continued to re-adjust,” he said.

“This supply driven perspective is combined with the ongoing price pressures consumers are facing at the shelf edge, as the cost-of-living challenges continue to bite.

“With well documented impacts including pressure on premium product categories across the protein matrix (pork, unfortunately, has not escaped this trend), consumers have often responded by reducing volumes purchased in premium categories or switching some purchases into standard market tiers.”

Short-term contract changes have the potential to further exaggerate market movements during this volatile period, he added.

“With these macro factors at play, alongside any short-term strains regarding contract commitments and make-up having the potential to exaggerate market movements, these recent trends may best represent a response to what remains a very volatile period for the sector.”