Prices in the primary pork market are holding their own, with a 10.2% year-on-year (yoy) growth, according to Kantar, which is 1.8 percentage points ahead of the increase for total grocery for the year to July 9, 2023.

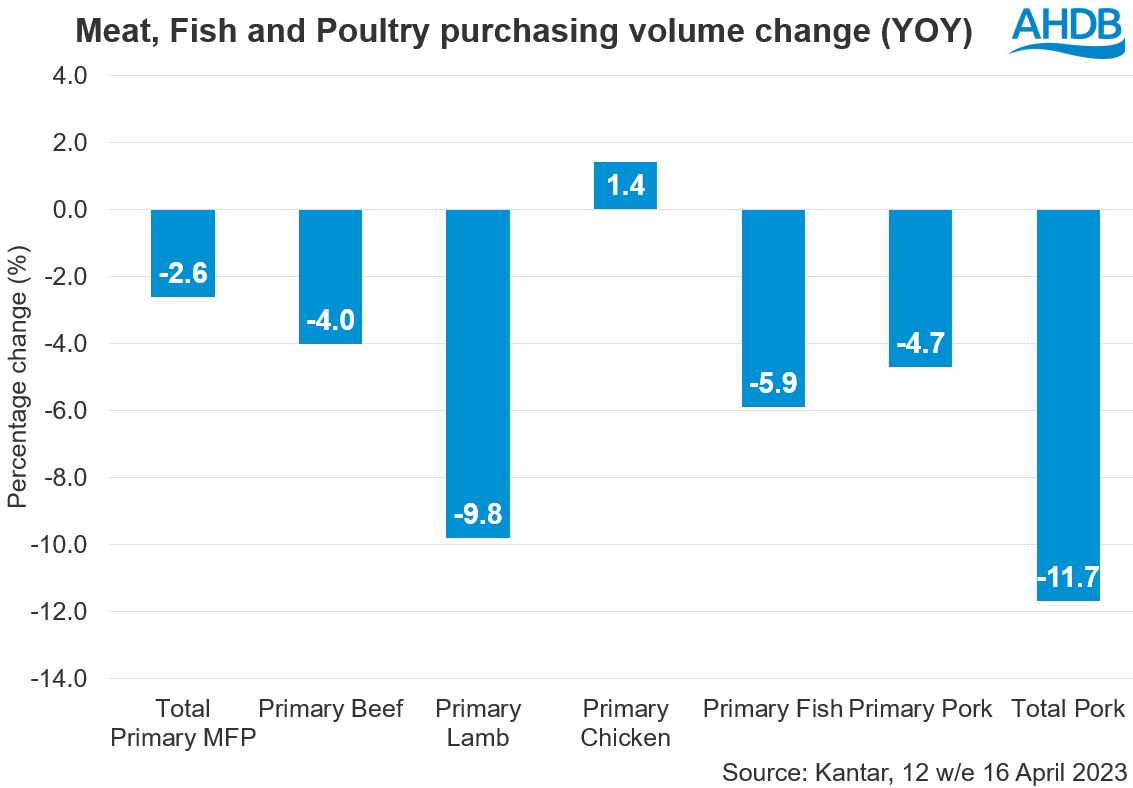

Tom Price, trainee analyst at AHDB, attributes this growth to inflation. He said: “However, according to Kantar, in the 52 w/e 9 July volumes sit 4.7% lower, 2.1pp more than the yoy decline for total meat, fish and poultry (mfp). This continues the 52 w/e declines seen since November. Whilst new shoppers are typically younger, majority of sales come from older shoppers, so it remains key to mobilise repeat consumers.”

Primary pork makes up 14.9% of total pork volumes but is one of the cheapest proteins at £1.50 cheaper than the average for total primary mfp (Kantar, 52 w/e 9 July 2023).

Falling behind other red meats

As primary pork prices have risen, purchasing volumes have declined, however it was the best performing red meat until July. Mr Price explained: “We are now beginning to see primary pork’s retail performance slip and its yoy volume decline outpace beef. This comes as the cost-of-living crisis causes consumers to trade down to cheaper products like mince and sausages, and cheaper proteins like chicken, as well as limiting their meat consumption in an attempt to save money. Consumers switching to primary chicken accounted for 26.2% of all primary pork volume losses yoy, as chicken is the cheapest protein on the market at £4.81/kg.”

Cuts

Steaks and roasting joints make up the majority of the primary pork volume (61.5% – Kantar, 52 w/e 9 July) but their volume decline has added to the general trend of declining retail volumes. However this is not the same for all cuts, as mince and pork loin medallions have risen by 17.5% and 14.9% respectively.

Consumer profiles

Mr Price explained that money saving is key for consumers in the current climate. He said: “Customers are trading down to cheaper meat to save money. This is evident as 139,000kgs of primary lamb switched to primary pork (Kantar, 52 w/e 09 July 2023). However, this is also occurring at the other end of the scale as people enter the pork market for the first time from more expensive proteins.

“New primary pork shoppers tend to be more affluent than lost shoppers and on average pay £0.82/kg more for primary pork than lost shoppers (Kantar, 52 w/e 11 June 2023).”

Opportunities

Mr Price remained positive about the outlook, explaining that the lower price point of pork products means it remains strong within the market. He said: “This means that over the coming months we could continue to see primary pork’s retail volume declines limited when compared to beef and lamb. If the cost-of-living crisis continues to the festive period, we could see increased demand for pork at Christmas as pork roasting joints are approximately 50% cheaper than that of beef and lamb.”