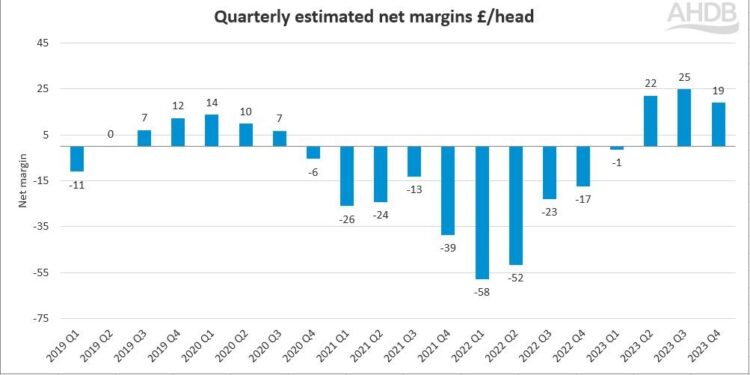

UK pig producers recorded a profit equating to, on average, £19/pig during the last quarter of 2023, as prices squeezed margins slightly, compared with the previous two quarters.

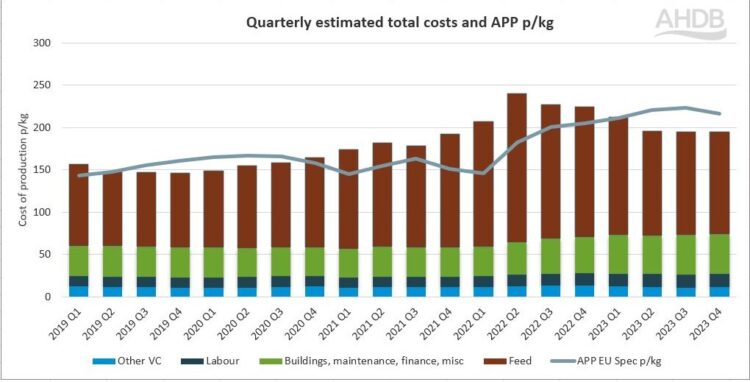

The latest AHDB quarterly cost of production and margin estimates indicate that the full economic cost of production for Q4 2023 was 195p/kg deadweight, exactly the same figure as recorded in Q3.

Feed costs remained consistent at 121p/kg, making up an estimated 62% of total costs Q4, compared with 69% in Q4 2022, when feed averaged 154p/kg and 73% in Q2 2022, when feed costs hit an eye-watering peak of 175p/kg.

Energy cost continued to fall over Q4, compared to high prices through 2022 and the beginning of 2023, but fuel costs rose slightly over the quarter, meaning overall production costs were unmoved.

Higher prices have ensured that pig producers have, on average, returned to profitability over the past three quarters, after 10 successive quarters of negative margins and accumulated industry losses estimated to be in excess of £750m.

Pig prices fell by around 8p during Q4, with the APP averaging 216p/kg to give a positive margin of 21p/kg or around £19/pig. This was slightly down on the Q2 and Q3 average margins of £22/pig and £25/pig respectively.

Pig prices have continue to decline gradually into the first quarter of 2024, although cereal prices have also been heading in the right direction.

These estimates use performance figures for breeding and finishing herds. However, due to changes in provider, the figures for Q4 2023 feeding and breeding herds use twelve-month performance data from March 31, 2023.