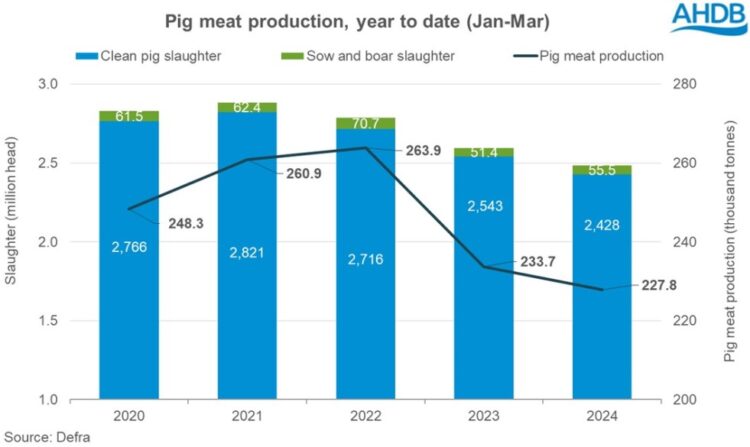

UK pig slaughterings plummeted to a 13-year low during the first quarter of this year, driving down pigmeat production volumes, according to official Defra slaughter figures.

UK pig meat production in the first quarter of 2024 totalled 227,800 tonnes, a decline of 2.5% on the same period last year and the lowest Q1 volume recorded since 2017. This decline slightly exceeded AHDB’s Agri-market outlook forecast of a 2% Q1 decline, made at the beginning of February. The forecast predicted a recovery over the rest of 2024, with the full year ending 0.6% up.

Total slaughter numbers – clean pigs plus cull sows and boars – for the period stood at 2.48 million head, the lowest Q1 kill recorded since 2011. Clean pig slaughter totalled 2.43 million head, a 4.6% year on year loss of almost 116,000 pigs. Meanwhile, cull sows and boars totalled 55,500 head, an increase of just over 4,000 head compared to Q1 2023.

The reduced slaughter numbers significantly outweighed the impact of a 1.6kg rise in average carcase to 90.5kg in Q1, compared with Q1 2023.

“Continued wet weather has been reported to be negatively impacting on farm productivity, which could further limit pig supplies later in the year,” AHDB analyst Freya Shuttleworth said. “The weather has also resulted in reduced plantings of arable crops over the autumn and is yet to ease off enough to allow for spring drilling. This is raising some concerns around feed ingredient availability and cost for the back end of the year.

“Continued wet weather has been reported to be negatively impacting on farm productivity, which could further limit pig supplies later in the year,” AHDB analyst Freya Shuttleworth said. “The weather has also resulted in reduced plantings of arable crops over the autumn and is yet to ease off enough to allow for spring drilling. This is raising some concerns around feed ingredient availability and cost for the back end of the year.

“Alongside this, straw prices have been rocketing upwards, with average prices now £40/t higher than last year. The 2023 straw harvest was poor due to a wet summer compounded by the fact that demand for straw has increased, with many cattle being housed for longer due to poor ground conditions limiting turn out. A poor harvest in 2024 is likely to add further flames to the fire.

“Despite improved farm margins, these factors suggest that plenty of hesitancy remains among producers and processors. This is likely to result in a continued recovery focused mentality following the challenges of the previous few years, outweighing any significant investment.”