Pork production in the US is on the rise, driven by productivity gains, as the breeding herd contracts.

The US inventory of all hogs and pigs stood at 74.5 million head on June 1, a 1% year-on-year increase, with fattening pig numbers up 2% to 68.5 million head, while the breeding herd declined by 3% to 6m head.

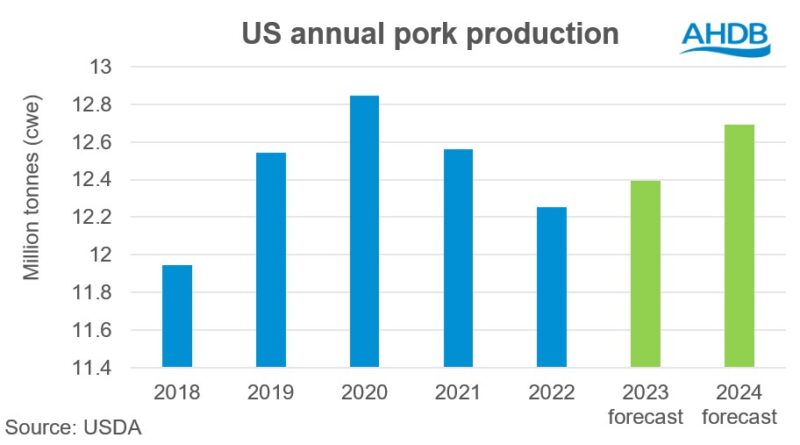

In the year to May), the US produced 5.3 million tonnes of pork, 1.9% ahead of the volumes produced during the same period last year, driven by productivity gains with slaughterings totalling 53.9m head for the period, up 2.3% compared to last year. According to the latest USDA data, US pork production is forecast to reach 12.8m tonnes in 2024, a 3.1% increase on 2023, according to AHDB analyst Soumya Behera.

Average carcase weights remained higher year on year in May and June further supporting production. “The seasonal decline in weight usually seen during summer is not yet showing, with reports suggesting that stronger pig prices and lower grain prices are encouraging some producers to maximise weight gain,” Ms Behera added.

Pig Prices

Since the end of January, US pig prices have been trading above 2023 levels. Average live weight equivalent prices in May recorded an increase of 19.5% year on year but have steadied in recent weeks.

The wholesale market has also seen a firm trend upwards in 2024 compared to year ago levels. Higher prices for bellies, loins and ribs have been reported to support the value of the whole carcass through June,” Ms Behera added.

“Robust pricing coupled with lower feed costs has resulted in healthy margins for some producers. Iowa State University’s Estimated Returns for Iowa Farrow-to-Finish operations show positive returns in May of $17.06/head. Steady to firm demand in the domestic and export market are expected to keep prices supported in the coming months.”

Trade

Despite higher prices, US pork is competitive on the global market due in part to lower feed costs and reduced shipping rates in comparison to the EU27 and UK.

In the year to May, US pig meat exports (excluding offal) totalled 1.09 million tonnes, an increase of 6.1% year on year. Good supplies paired with competitive pricing has resulted in significant increases in volumes shipped to most of the key destinations with the exception of China, Dominican Republic and Canada. Mexico is the dominant destination for US pork exports, with a 40% market share of volume.

Rabobank are forecasting US pork exports to grow by 6% this year, with improved demand anticipated from Asia in the second half of the year.

Over the first five months of the year, imports (excluding offal) totalled 202,200 tonnes, a 7.5% increase year on year, driven by good demand, supported by higher prices for competing proteins, is reported as a key driver, Ms Behera added.

Canada remains the most significant provider of pork to the US holding a 63% market share, while UK shipments to the US totalled 2,400 tonnes over the period.