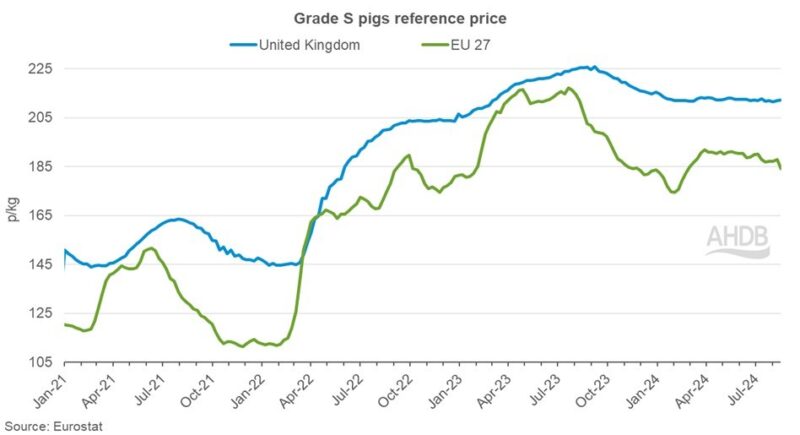

Uncertainty has crept into the European pig market in recent months, with prices, on average 23p behind a year ago, but still historically elevated.

The price differential between UK and EU prices is widening. In the latest week (ending August 18), the EU27 average for grade S pigs stood at 184.25p/kg, a decline of 3.5p week on week, although, it is worth noting that the Netherlands have not declared a price this week, AHDB senior analyst Freya Shuttleworth pointed out.

Taking a longer term view, despite weekly price fluctuations, EU grade S prices have only moved by 2p since the start of the year. The price differential between the UK and EU has been between 21p and 26p over the last five months, in the latest week the gap has widened to 28p, the largest gap seen since the end of February.

All key producing nations saw price declines in the latest week, between 3.3p/kg (Germany, Spain, Denmark) and 6.1p/kg (Belgium), with most countries having trended downwards since the start of July, with the exception of Spain and France, where gains have balanced with losses.

“It is likely that some downwards pressure could be felt within the European market in the coming weeks and months as the balance of supply and demand dances a fine line,” Ms Shuttleworth said.

Production

Pigmeat production in the EU27 has been improving compared to the previous year, increasing by 3% between January and May to 8.95 million tonnes, driven by increased slaughter (+1%) and heavier carcase weights.

“Demand on the other hand has continued to be subdued as consumers, both domestically and internationally, continue to hold their purse strings tight,” Ms Shuttleworth said.

“Due to increased competition on global markets, the EU has lost out on some export demand. Meanwhile, domestic consumption has been impacted by the wet weather, particularly in northern regions, with BBQ season reported as disappointing.

“Uncertainty has crept into the European market in recent months. The announcement by China to launch an anti-dumping probe on imported product from the EU has caused some upset and caution within key exporters.

“Exchange rates have also seen additional volatility following political elections and changes in economic policy and interest rates. It is likely these concerns will continue to rumble on for the rest of the year.

“Alongside these challenges is the spread of ASF. Germany has reported several new outbreaks this summer, closer to their western border. If the disease continues to spread west there could be significant issues with trade, especially if an outbreak occurs in Spain, the largest exporter.”