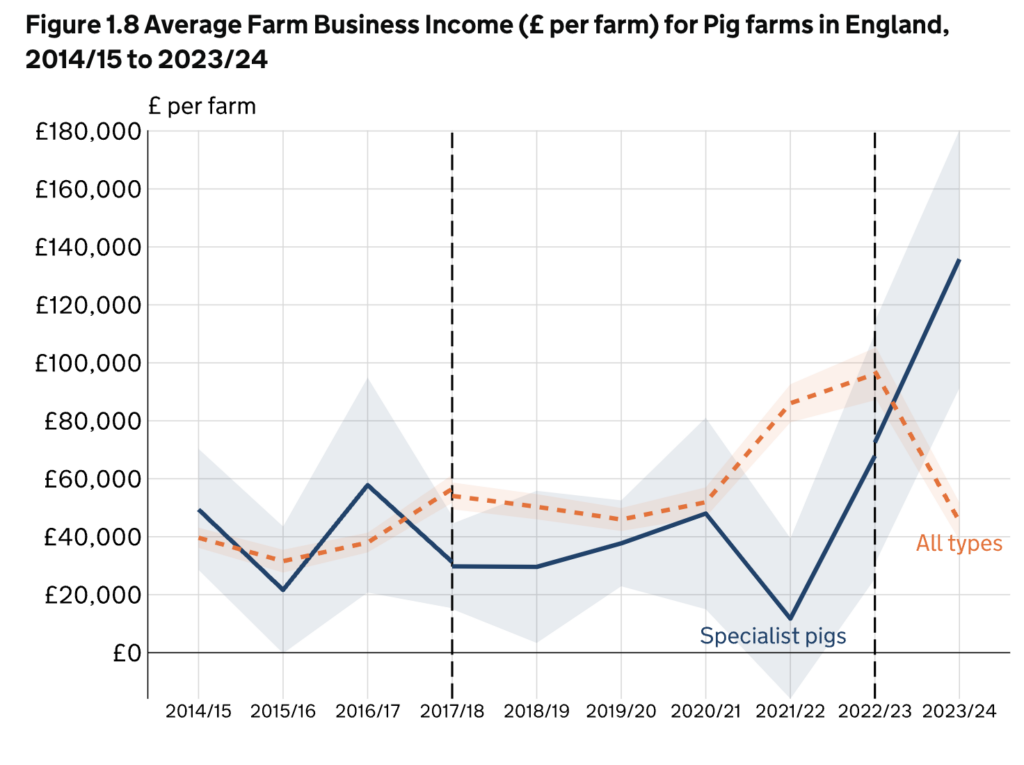

Average Farm Business Income for specialist pig farms in England rose by 87% to £135,800 in 2023/24, reflecting higher throughputs and prices, according to newly-released Defra figures.

For pig farms, which suffered a huge financial crisis in 2021 and 2022, this was a rare year when net farm incomes were above the average for all sectors. However, for the wider farming industry, the Defra figures showed significant falls across the board.

Pig farm outputs increased by 25% during the year, reflecting higher throughput and prices for both store and finished pigs. In contrast to other farm types, for those pig farms growing crops, output rose with an increased average area of wheat and barley offsetting lower prices and yields.

This increase in output more than offset an 8% rise in variable costs, driven mainly by higher animal feed and other livestock costs, and a 21% increase in fixed costs, most notably for labour, general farming costs and electricity.

Revenue from diversification rose 59% to £71,800, another major contributors to the overall rise in incomes, with food processing /retailing, other diversified activities and renewable energy were the main drivers. Average agri-environment payments also rose in 2023/24, more than doubling to £7,900.

Defra notes, however, that the pig figures should be treated with caution because of the small sample size and the wide confidence intervals of £91,000 to £180,000. Contract rearers are well represented in the FBS sample, but business models for contract rearing operations are varied and these types of farms may not be impacted by price variations to the same extent as non-contract rearing farms.

Wider farming picture

While the last financial year was certainly an improvement for the pig sector in the context of recovery from its deepest crisis, and poultry incomes also rose, other sectors suffered. Defra’s Farm Business Income figures also showed:

-

- A 73% fall in average cereals income to £39,400.

- A 24% on general cropping farms to £95,300.

- A 68% fall on dairy farms to £70,900.

- A 24% fall to £17,300 and a 12% fall to £23,500 respectively, for lowland and LFA grazing livestock.

- A 67% fall for the mixed sector to £22,700.

- A 38% fall for the horticulture sector to £59,100.

NFU President Tom Bradshaw said the figures ‘paint a stark picture of the challenges facing many farmers’, with rising input costs, significantly lower commodity prices, a reduction in direct payments and one of the wettest winters in decades leaving many businesses worse off.

He said they underlined why the government was wrong to reform Agriculture Property Relief (APR) and Business Property Relief (BPR), leaving farmers facing huge inheritance tax bills.

“Profitable farm businesses are essential if we are to deliver what the country needs; food security, with food produced to world leading standards and environmental protection,” he said.

“Instead, we have seen the opposite. The recent Budget announcing changes to APR and BPR have left farmers reeling. Many will be faced with a tax bill of millions. Some will be forced to sell all or part of their farm to raise the funds.

“These are the working people of our countryside, the majority of them working for little profit but happy in the knowledge their life’s work will mean they can pass the farm on to the next generation. This tax threatens to change all that. It threatens our food security and with the compounded impact of National Insurance and National Living Wage changes, it threatens to push up food prices for consumers.

“There has been a clear Treasury miscalculation of the impact this will have on farmers and growers. The Treasury has simply got its figures wrong2. This policy won’t protect family farms, it will do the opposite.

“At last year’s NFU Conference, we heard from Sir Keir Starmer that ‘Losing a farm is not like losing any other business, it can’t come back’. He was absolutely right. It can’t. And neither can its ability to produce food for the nation.

“The pressure is building. Defra and the Treasury are aware that on November 19, NFU members will be making their way to Westminster to take part in our mass lobby of MPs. We will be looking them in the eye and asking if they support this family farm tax, or if they will do the right thing for their farming constituents and support our call for it to be reversed.

“The only sensible course of action is for the Treasury to reverse this decision and soon.”