Modest pork production growth is expected in 2025, as political uncertainty casts a shadow over global trade, according to RaboResearch’s latest quarterly pork report.

It says pork producers are choosing a ‘cautious yet strategic’ approach to expansion as they navigate stabilising profitability and a promising demand outlook for 2025.

While production costs are expected to decline, uncertainties in animal health and global trade persist. Producers are, therefore, prioritising productivity, cost efficiency, and adapting to changing consumer needs.

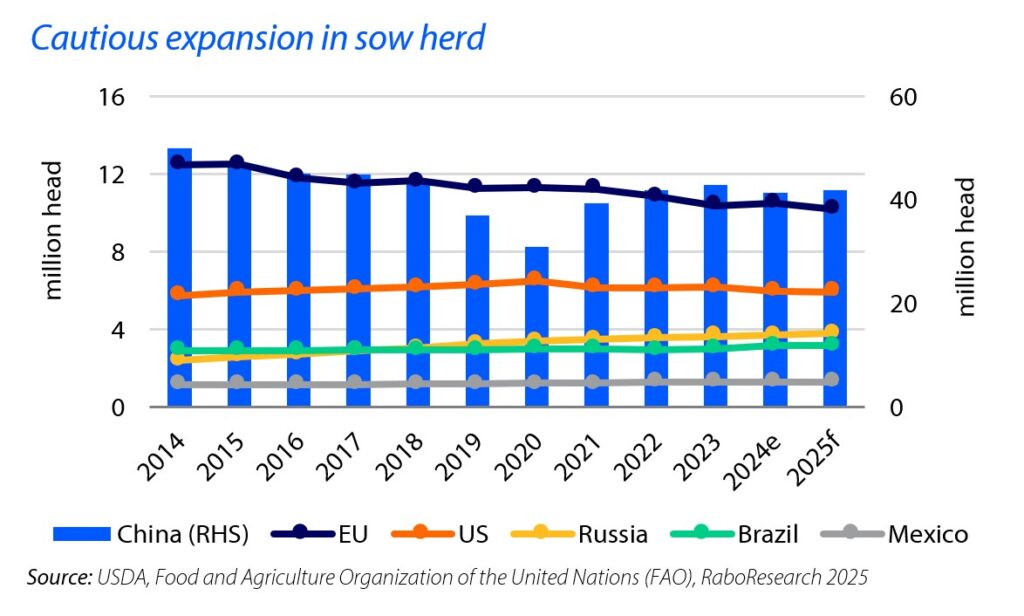

Despite positive profits in 2024, herd expansion remains slow, with slight production increases in China, Brazil, and Mexico, offset by decreases in the EU and the US. Favourable production conditions are anticipated in 2025 and sustained profitability will be crucial for attracting investment, according to Chenjun Pan, senior analyst – animal protein for RaboResearch.

Manageable feed grain prices and improved animal health are expected to support stable global pork supply, which is forecast to grow by less than 1% this year. Regional supply and demand balances vary, however, with sufficient supply in the US, China, and Brazil, and tighter supply in the EU, Japan, and the Philippines.

Competitive prices

Pork prices underperformed in 2024 compared to other meats. “Lower feed costs and enhanced productivity have made pork more competitive, a trend likely to continue in 2025,” Ms Pan added.

“Pork is well-positioned due to its reasonable pricing and availability, especially as beef prices remain high and poultry demand strong.”

Pork demand is expected to rise in North America and Brazil, where beef supply is tight. Europe may experience seasonal price increases, while Asia sees price fluctuations, with downward pressure in China and South Korea, but strong prices in Japan and south-east Asia.

Global trade uncertainty

Ms Pan warned that president Trump’s tariff policies could significantly impact trade flows. “High tariffs on imports from China, Mexico, and Canada may lead to retaliatory measures affecting agricultural goods, including pork,” she said.

On top of this, geopolitical factors like a potential Ukraine-Russia ceasefire add uncertainty to grain prices, influencing pork production costs.

Disease outbreaks, such as the recent foot and mouth disease outbreak in Germany, further complicate the trade landscape.

In such a volatile market, participants along the supply chain may increase their focus on risk mitigation, Ms Pan added.

Meanwhile, outbreaks of African swine fever and porcine respiratory and reproductive syndrome virus (PRRSv) continue to challenge production and exports.

The pork industry and governments are investing in solutions like vaccination, biosecurity and animal health products, while at the same time, sustainability and animal welfare concerns are also driving the need for innovation. Investments in technology, including automation, digitalisation and AI are increasing, with many large-scale farms already using sensors for disease diagnosis and monitoring.