Retail pigmeat volume sales were down in the 12 weeks to January 26, but the value of sales increased slightly on the back of higher prices, according to the latest data from Kantar.

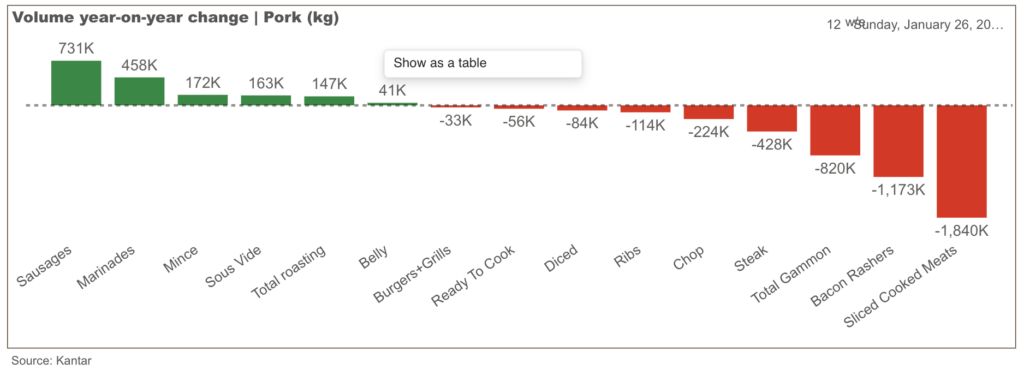

The 1.2% year-on-year decrease in volumes of pigmeat purchased was equivalent to 2,824 tonnes less than the same period last year, according to AHDB’s summary of the data.

The decline was partly driven by a 2.4% fall volumes of processed pigmeat, with bacon down 3.3%, gammon down 3.9%, sliced cooked meats down 5.5% and burgers and grills down 3.2%. Sausages were the only processed cut to see volume growth (+1.8%), due primarily to an increased frequency of purchase.

Purchases of primary cuts decreased 1.9% this period, with steaks down 6% and chops down 8.4%. Total roasting saw a 1.1% increase in volumes purchased, due to improved leg roasting performance (+15.3%) due to an increase shopper numbers, helped by an increase in promotional activity and lower prices. Shoulder (-3.9%) and loin (-3.2%) roasting volumes declined, however.

Belly saw a 1.5% increase in volumes purchased due to an increase in buyers this period, however, while mince saw a 5.3% volume increase due to an increase in volumes purchased per shopper, and an increase in shopper numbers. An increase in promotional purchases during this period will have also helped to boost volume sales, as average price decreases, AHDB noted.

Added value also saw overall volume purchased increase (+8.6%). This was due to sous vide (+4.8%) seeing increased shopper numbers, while increased promotional activity for marinades attracted in new shoppers resulting in a 31.3% increase in volumes purchased.

Spend increases

Despite the lower volume sales, spend on pig meat increased by 0.4% year-on-year due to a 1.6% increase in average prices paid.

Spend on primary pork, where British product is strongest, was down by 0.5% to £206.5m, with a 1.3% gain in the roasting category.

Processed pork sales volumes were down 1.2% to just over £1bn, with sausages (2.7%) and gammon (1.2%) both making year-on-year gains. Added value, unsurprisingly, also made gains, led by marinades (25.9%).

Beef and lamb sales

For comparison, spend on beef products increased by 5.8% year-on-year over the 12-week period, due to a combination of a 0.7% increase in volumes purchased and a 5.1% increase in average prices paid.

Lamb saw a 4.1% decrease in volumes purchased, with spend up 0.3% due to a 4.7% increase in average prices.