A 4% rise in UK pork production last year helped keep import levels relatively stable, despite lower EU prices, although import volumes did pick in final quarter of 2024. The increased availability of UK pork products did not translate into higher export volumes, however.

The UK imported 789,300 tonnes of pig meat (including offal) in 2024, up by 1%, 7,500t, on 2023, although monthly volumes have fluctuated across the year. There remains some seasonality to pig meat imports, with volumes typically picking up ahead of peak demand periods such as Christmas, AHDB analyst Freya Shuttleworth noted.

However, as EU pig prices fell substantially, while UK prices only saw marginal movement, Q4 2024 imports were up 2.7% compared to Q4 2023, with both October and December recording year-on-year increases of just over 4%,while November recorded virtually no change compared to 2023. “This suggests, that despite cheaper EU imports, demand for domestic product was sustained, possibly supported by British retail facings,” Ms Shuttleworth said.

Over the full year, volume declines in bacon (-2.2%) and processed pig meat (-7.0%) were outweighed by growth in sausage (+4.8%) and fresh & frozen pork (+2.4%).

Fresh & frozen pork accounted for 43% of total pig meat import volume at 339,400 tonnes, with Denmark, Germany, Spain and Belgium the key suppliers. Bacon makes up the second largest share of import volume (22%) at 176,500 tonnes. Over 100,000 tonnes of total bacon imports came from the Netherlands, with Denmark making up most of the remaining volume.

For sausages and processed pigmeat, Poland and Ireland are key suppliers, alongside Germany and Spain. Sausage volume growth has been driven by increased shipments from Germany, Ireland and Italy, while volumes from other key players remained stable year-on-year. However, volume decline in processed pig meat has been seen across all suppliers.

Exports

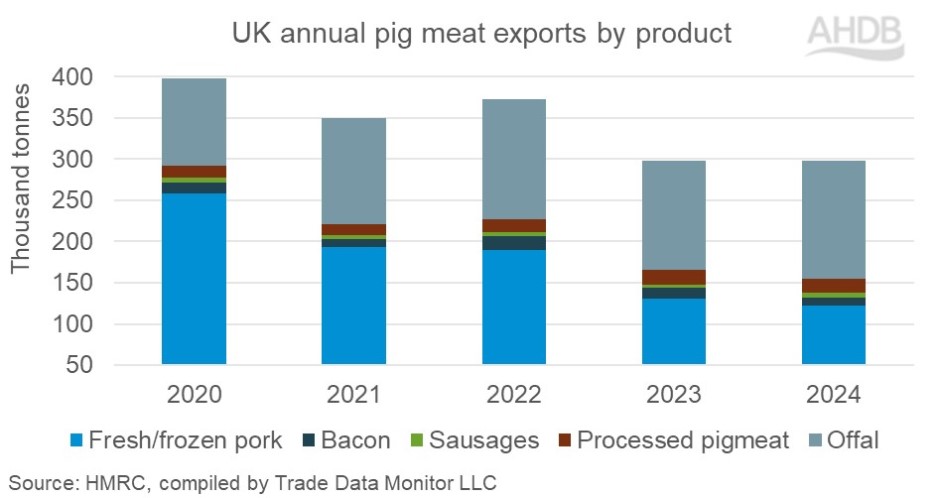

The UK exported 298,100 tonnes of pig meat (including offal) in 2024, a marginal decline of just 0.1%, 400t on 2023, despite the 4% growth in UK pig meat production volumes. “Domestic pig prices held firm through 2024, despite external market pressure, making UK product less competitive on the global market,” Ms Shuttleworth added.

Shipments of offal continued to record significant growth, up 9,300t annually. Export volumes of processed pigmeat and sausage also increased, but from a much smaller base. However, strong declines in fresh & frozen pork and bacon, down 8,000 tonnes and 3,200 tonnes respectively, tipped the overall balance.

The EU remains the UK’s largest destination for pig meat exports, accounting for 42% of total volume (124,900t). However, volumes have slipped year-on-year (-6,400t) as EU production gains and weaker consumption across the continent have impacted import demand for the region. Ireland, Germany, the Netherlands, France and Belgium account for 90% of UK shipments to the EU, with almost half of this made up of fresh & frozen pork.

Despite a stagnant Chinese economy, UK shipments to China have grew 7% year-on-year to 120,100t. This growth has been driven by offal, which make up 65% of total shipment volume, while, shipments of fresh & frozen pork have continued to decline, down 10% compared to 2023. The re-listing of two UK plants before Christmas may further support UK pig meat exports to China in 2025, Ms Shuttleworth added.

The Philippines continues to be a lucrative market for UK exports. In 2024, pig meat shipments increased by 3,100t to 20,400t, with volumes primarily made up of offal (77%).

“The UK benefits from reduced tariff rates on pig meat shipments to the Philippines, a measure introduced by the Philippine government to secure supplies and keep consumer food costs down whist the domestic pork industry battles with African swine fever,” Ms Shuttleworth said.

“Other key destinations of UK pig meat exports are the US, South Africa, Dominican Republic, South Korea and Cote d’Ivoire. With the exception of the US and South Africa, which receive a good proportion of fresh & frozen pork, the vast majority of product going to these alternative destinations is offal.”