At the time of preparing this report the latest SPP had yet to be published and currently stands at 200.48p, but hopefully the signs are that it will continue its steady recovery.

The shortage in pig numbers throughout the UK and EU is continuing to contribute to much firmer base prices and although the latest influential German producer price is holding at stand on levels at 2.00 EUR, industry sources are expecting this to lift once we move into the New Year.

The spot market has gone from being the coldest to the hottest with buyers short of pigs and leading quotes in the 205p – 210p/kg range.

Unfortunately, however, one dark cloud that continues to trouble the industry is the disconnect between UK weekly contribution prices which have yet again remained unchanged, ranging between the lowest price of 165p/kg from Karro, 178p/kg from Cranswick and 180p/kg from Woodheads.

The inclusion of such low weekly contribution prices seems to be completely out of touch with actual prices elsewhere.

Cull Sows

Now the holiday period is drawing to a close cull sow buyers are looking to refill empty fridges and a weaker Pound also helped to put up the price of cull sow exports with the Euro worth 88.7p.

Those producers with cull sows to sell should be able to achieve prices of between 86p – 91p/kg which are hopefully a green light for sow prices to remain firm, which has not always been the case at this time of year.

Weaners

RSPCA Assured 7kg weaners are much easier to sell and prices are in many cases putting producers in the black with prices in excess of £50/head on some contracts.

At the same time, spot buyers who had until recently been standing in the wings are now coming out and are prepared to give much more realistic and sustainable prices. Buyers are also looking to secure regular contract supplies which may become available to fill empty pens.

Feed Market Trends

The ongoing warfare in Ukraine has tended to put up futures prices, although the latest UK spot ex farm feed wheat average has fallen by £4.30/t to £224.70/t.

In the futures market feed wheat for February 2023 delivery has risen to £250/t and next September is also up at £240/t. Feed barley futures prices have also followed this slightly firmer trend and traded for February 2023 delivery at £230/t and £224/t for September next year.

Protein values continue to rise with Hipro soya for February 2023 delivery at £539/t and deals for May – October 2023 have been agreed at £491/t, which is a £15/t increase over the past seven days. Rapemeal prices for February – April next year are quoted at £363/t and for May – July 2023 £315/t.

And finally…

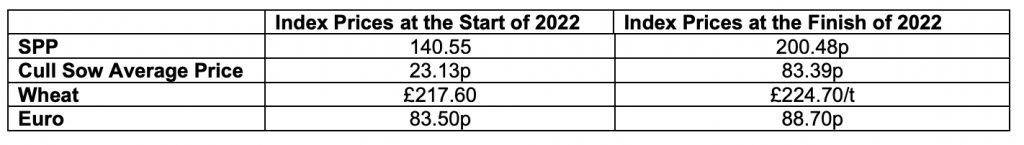

The year end is usually an interesting time to compare price movements over the past twelve months and it would be an understatement to describe the whole pig supply chain year as anything other than extremely volatile.

At the same time other challenges to be faced include the ongoing risk of African Swine Fever reaching these shores as well as the threat that Coronavirus may be on its way back and could create havoc with the whole pig production system.

Hopefully our industry can look forward to a more productive 2023……….we shall see! In the meantime, have a peaceful and prosperous New Year.