After two very comfortable years, the Russian pig industry is entering a harsh period, when dozens of small and medium companies will be pushed out from the market and go bankrupt. According to the chief forecasting analyst at the National Union of Pig Producers of Russia (NUPP), Nikolay Birulin, the industry is currently experiencing an acceleration of monopolisation, while decreasing prices force manufacturers to think more about protecting profitability. It’s a similar situation that can be seen today across much of the former Soviet Union.

According to NUPP, this year Russia will produce 3.26 million tonnes of pork, with 1.98 million tonnes coming from the facilities of the top 20 largest producers. These companies are expected to increase market share from last year’s 58% to 61%, while in the next four years this figure should grow to 75%.

By 2020, Mr Birulin expects the overall size of the Russian pork market to reach 3.58 million tonnes, and that’s despite the reduction of demand that’s currently being seen. And he expects increasing production volumes will see the bigger Russian holdings push out smaller producers as competition in the market gets stronger.

In 2014-2016 the Russian market experienced a pork deficit as food embargoes and the falling ruble cut imports. However, this year the trend is absolutely different with the first signs of oversupply already observed. NUPP says this will result in a reduction in prices of 10 to 15% from 112.8 rubles/kg (116p) in central Russia to 95 rubles (97p) in 2016. As a result, Mr Birulin suggests pork producers should forget about high incomes, as in coming years pork farmers will have to struggle for every ruble.

Oversupply has also affected the market in Ukraine, where in the first quarter of this year prices collapsed by 3.0 hryvnia/kg (8p) to 25 hryvnia/kg (68p). One of the main problems in Ukraine is the loss of access to the Russian market, as since January this year the Russian government has introduced food import restrictions against the country. As a result, Ukraine’s pork exports have collapsed to less than 1,000t for the first quarter of 2016. It’s estimated that about 30% of all pork producers in the country are now operating at a loss, and this situation has negatively affected the investment potential of the industry.

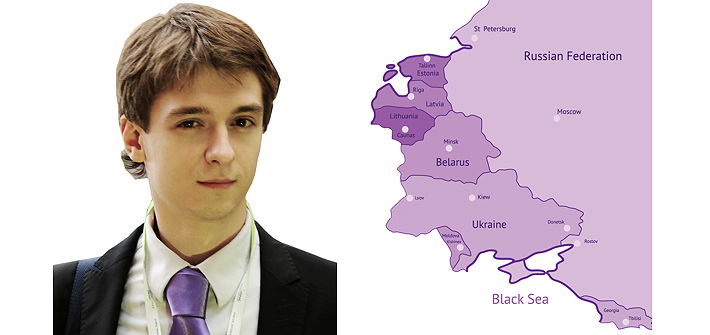

Most countries of the post Soviet Union focused on exporting a significant part of their production to Russia in the past, but the recent food embargoes have resulted in a redistribution of export flows – and this process has still not ended. There have been a number of trade conflicts in the region in recent months.

In particular, Moldova has put restrictions on meat and milk imports from Ukraine. This followed a period where Ukrainian farmers increased deliveries of pork to Moldova to such an extent that the price of meat in the country collapsed by nearly 20%.

A similar situation occurred between Poland and Lithuania. After losing access to the Russian market, Polish producers initiated increased deliveries to the Baltic States, where there was already an excess of capacity. As a result, the authorities in Lithuania have had to consider supporting measures to meat producers so they could successfully compete with Poland. One of these is the reduction of VAT on meat from 9% to 5%, which has also been adopted in Poland. It’s believed that in Lithuania VAT will be reduced from October this year.

Shortly after the food embargoes were introduced, most Eastern European countries to the west of Russia claimed they would develop supplies to alternative markets. However, so far this has been limited to juggling pork shipments, with Poland, Latvia, Lithuania and Estonia mostly supplying it to each other and some other members of EU; no meaningful alternatives to the Russian market have been found by these producers.

In March, Lithuania announced it launched deliveries to the US, with about 10t exported. The country’s government believes that this could be an important trend, as the US is a huge market and could absorb some of the pork previously supplied to Russia. However, the Lithuanian authorities had similar intentions with regard to China, but failed to establish large-scale exports.

The export potential of the Baltic States has been rather undermined by the continuing epidemic of African swine fever (ASF). According to official data, the area affected by the disease has increased by nearly a third in the past 18 months and is continuing to grow.

A significant part of all three countries is now included in quarantine zones, which can’t export pork abroad – or even sell it outside of these zones. For most of the producers affected, the oversupply problem is now a major problem.