AHDB shared some of the latest research into shopper behaviour at the second Consumer Insight conference

Producers have, since the 1980s, been facing declining domestic demand for pork products, so we often ask ourselves why is

the product we love so much and rear so conscientiously losing the appeal it once had? Why is our delicious pork, with its low price point, simply not flying off the shelves?

So many factors influence the way consumers live their lives and spend their time and money. Research specialists Kantar World panel and IGD joined AHDB at its second annual Consumer Insight conference in Stratford-Upon-Avon in late-September to dedicate a whole day to sharing the latest insight into changing consumer behaviour.

The aim was to prepare an audience for food industry marketers, growers, producers and processors for this shifting consumer environment.

Expert speakers presented their research, providing explanations for how and why shopper behaviours and attitudes have changed, and how exposure to the media is altering the way people think and shop. The research explored some of the key drivers for consumer behaviours and looked at the role farmers can play in boosting trust across the industry.

Segmentation

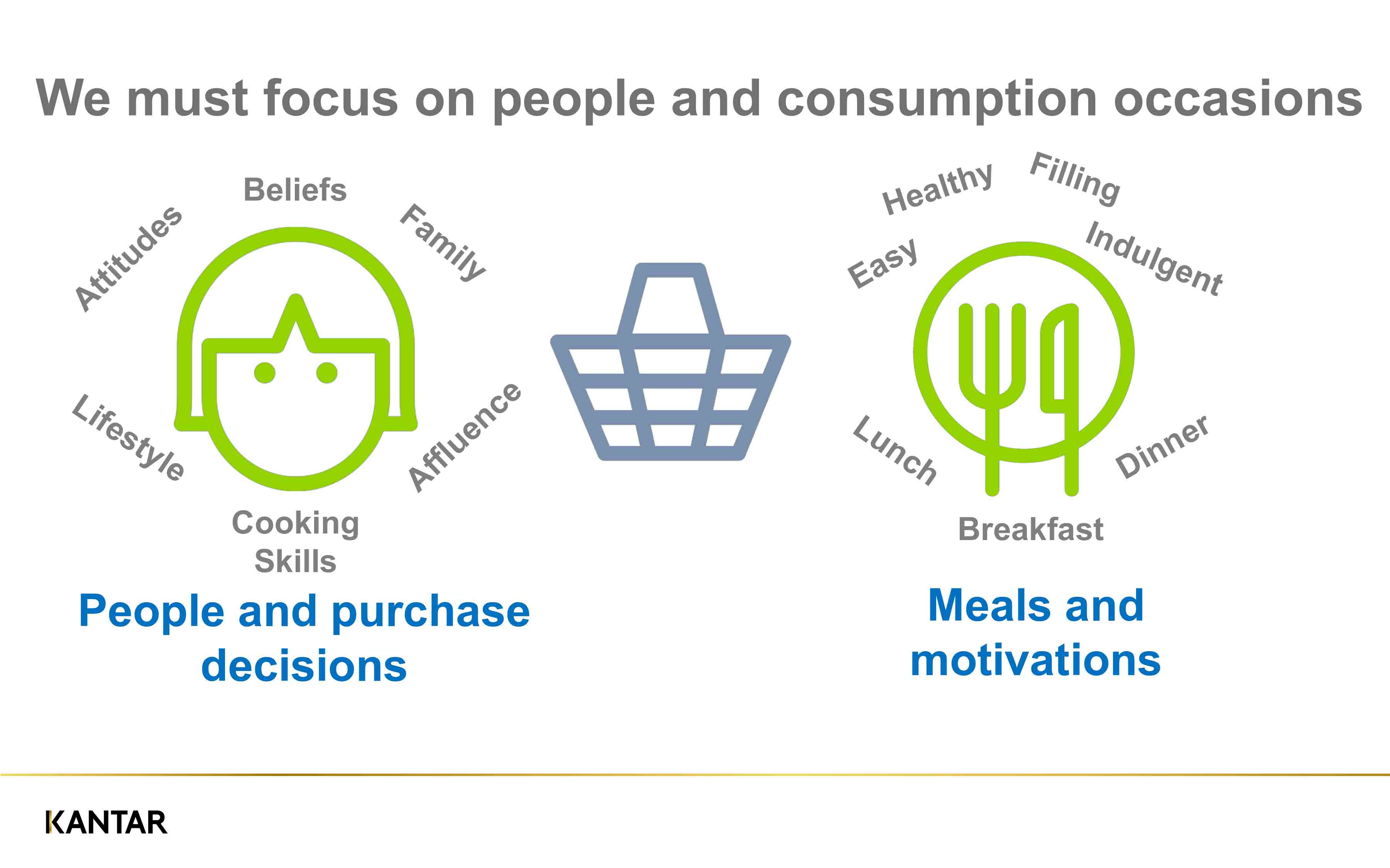

Consumers’ motivations and buying behaviours differ depending on their attitudes and influences, as well as the meal occasion (breakfast, lunch, dinner) in question. Kantar and AHDB have jointly built a segmentation model that analyses the meat-buying population and seeks to understand how individual groups behave.

This sophisticated work goes beyond splitting consumers using simple demographics or social economic groups – it separates people into segments based on their common needs, attitudes, actions, priorities and behaviours. It looks at these things at the point of the specific ‘consumption moment’. Called a ‘demand framework’, it can be used by marketing professionals for more accurate targeting.

To grow or defend pork, more people need a reason to buy. This segmentation work puts consumer insight into the heart of the thought process when creating marketing campaigns promoting pork.

The work looks at the motivations behind the buying decision, specific to the meal’s occasion or need. If we look at the humble bacon sandwich as an example, there are so many variables. As a food item, itself, is the sandwich made with organic outdoor reared back bacon with artisan bread? Is it an economy streaky rasher or two on white sliced with ketchup? Or is it premium outdoor bred in a brown roll?… but, more importantly, what is the meal occasion?

Is it part of a weekend couples treat, or weekday grab-and-go fuel? It could be part of a family Sunday tradition or a lunchtime BLT on the go.

Understanding the segment behaviour is the most important thing. It will help in strategy development within food businesses and in the creation of credible and effective marketing campaigns. For success, marketing must understand shoppers’ emotional connection to your product and reflect the way modern shoppers find and buy food.

The Shopper Journey

A large majority of consumers plan meals, and then shop. They have different needs for weekday meals versus weekend meals. Research showed that proteins need to be top of mind and meet these meal criteria to make it into a meal or shopping plan.

We know that price and taste are key decision drivers at the point of purchase. Contrary to what people consciously think, convenience factors (quick/easy/part of a specific meal) become more influential at the point-of-purchase, while origin and other labelling claims become less important. This suggests that a good tactic would be to include meal inspiration images and convenience messaging on packs and at point-of-purchase.

What About Red Meat?

Consumer expectations are evolving. Price is important and still has the biggest influence over what actually goes into the shopping basket (despite what they tell you about buying on welfare claims), but we know that consumers are now looking for meal solutions that suit their lifestyles.

Meals are shifting from traditional ‘meat and two veg’ to global dishes like Indian, Italian and Chinese. This means quick, easy and healthy. This translates into the need for meal kits and accompanying sauces, all of which need to be reliable and fail-safe.

This is where there are real opportunities for pork. It ticks the all-important consumer need for convenience and value, but along with other red meats it shouldn’t rest on its laurels but instead look to further communicate how it can be used in a variety of popular world cuisines.

The other side of the coin for pig producers is that reputational risk areas, such as the environment and animal welfare, are becoming increasingly significant drivers for behaviour change.

The media pressure around these subjects, especially the environment, is great and growing.

Source: Kantar

Trust and the Producer’s Role

Despite 83% of the UK population living outside rural areas, consumers are becoming increasingly interested in where their food comes from and how it’s produced. TV programmes specialising in ‘behind the scenes’ food production are becoming popular, with millions tuning in to see mayonnaise, breakfast cereal, bread and sausages whizzing their way through miles of pipes and processes.

This increased interest in provenance and understanding of process is prompting a shift in consumer attitudes to the food they once selected without thinking beyond its nutritional credentials. Awareness of key issues like environmental impact (especially plastic and climate change) are on the increase and animal welfare awareness is continuing to grow and shift consumers’ moral compasses. When asked, consumers are increasingly looking for production that is more ethical.

Consumer insight work has identified, not surprisingly, that consumers have very individual feelings about the four pillars of food production – welfare and ethics, environment and sustainability, food safety and provenance.

Farmers hold the key to building trust in the food system. The paradox is that, while welfare is not the top driver for buying decisions, its stated importance is growing more quickly than the other drivers, up 12% year-on-year.

Attitudes towards British agriculture, as a whole, are broadly supportive. It is likely that little can be done to change the minds of the 5% who are negative about the industry, but there is still more to do to shift the 26% who are yet to form an opinion. Worryingly, livestock sectors are less well regarded, with pig and poultry farming at the bottom of the pile, with 12% and 14%, respectively, harbouring a negative opinion of these industry sectors.

But it’s not all doom and gloom. When compared with the other groups within the supply chain, including processors, supermarkets, food service and government agencies, farmers are considered the most trustworthy, with 71% of those surveyed agreeing they trust farmers. Something to build on certainly…

So, what can the industry do? We can demonstrate that we share the same values as our customers and view ourselves through the eyes of the consumer. We can find the easy wins, where science and sentiment coincide. We can listen to what our customers are saying, so we produce what they want to buy into.

Being transparent, accessible and eliminating any bad practices from the industry should all be at the forefront if we want to build greater trust in our sector for the future.

More information

Details of the consumer insight work can be found on ahdb.org.uk/retail-and-consumer-insight or by contacting strategic.insight@ahdb.org.uk