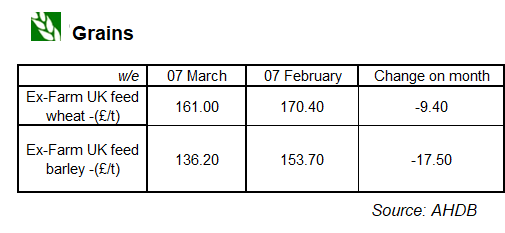

In its latest commentary on the global cereals and oilseeds markets, AHDB has reported that UK feed grain prices fell again over the reference period.

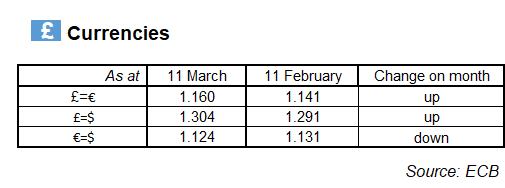

Sterling continued to strengthen over the month, with grain prices falling to stay competitive with EU markets. Relatively slow global exports have led to a build-up in grain supplies, acting as a ceiling for prices. UK barley prices continued to fall amidst increased maize usage, up 134% on the year for January.

Barley usage in January was at its lowest levels since 2012/13. The feed barley discount continues to grow, now £24.80 compared to feed wheat.

AHDB analyst Alex Cook said: “Towards late February, there was news of the Ensus plant restarting its bioethanol production three months early. Despite initial positivity, the plant looks set to focus on maize as its primary feedstock. As such, wheat markets feltlittlepositive impact.

“New-crop wheat futures (Nov-19) began to fall over February, narrowing the spread to old-crop (May-19). Expectations of a larger new-crop harvest have pressured futures markets. Weather remains the key driver for crop forecasts, with warmer conditions in February contributing to good crop establishment.”

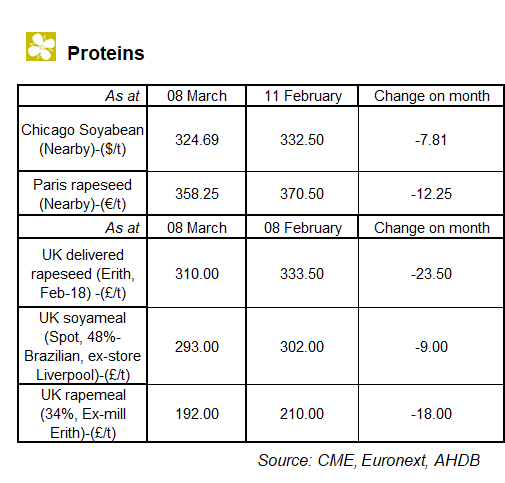

Over the month, UK delivered rapeseed prices fell in line with declines observed on the continent. Reduced demand from the biofuel sector has led to an increase in stocks. In addition, increased pressure from vegetable oil markets has also impacted prices. Furthermore, a strengthened sterling meant domestic rapeseed prices fell to remain competitive.

Mr Cook added: “Progression in US-China trade talks was positive for soyabean markets over the last month. Prices were initially raised due to a Chinese commitment to purchase 10Mt of US soyabeans. However, US soyabean markets then fell back over the month as the Brazilian harvest got underway at a pace well above the five-year average, increasing global supply.”