AHDB said recent analysis concerning a no-deal situation has renewed relevance as the UK draws closer to another Brexit deadline.

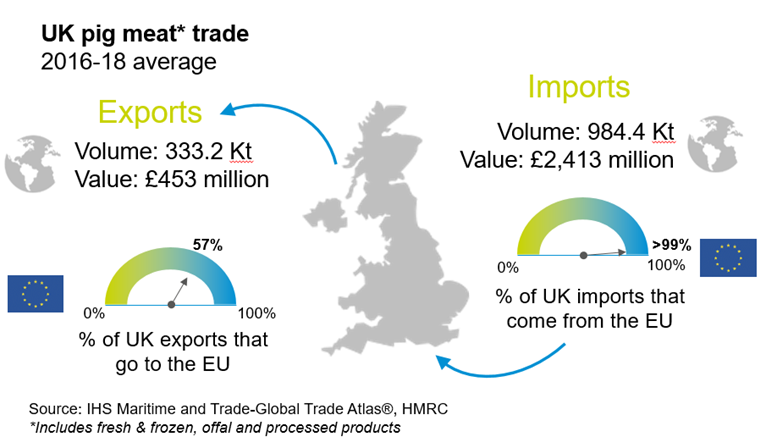

The UK is a net importer of pig meat products, particularly processed pork. However, considerable volumes of pig meat products are both imported from and exported to the EU. Under a no deal situation, proposed UK tariffs mean there will be significant differences in the tariffs for imports to the UK, and for exports into the EU. These differences will bring a number of challenges for the industry.

Key Points

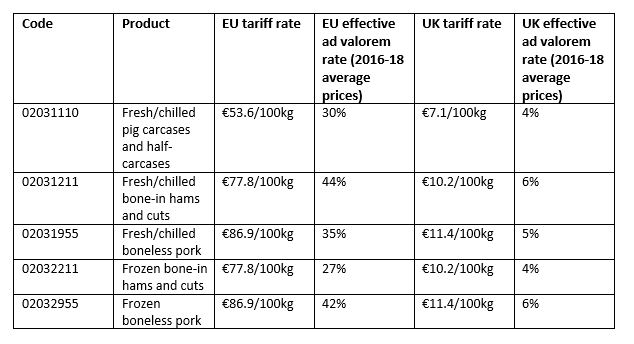

- Import tariffs are proposed on most pig meat products, at a rate lower than the EU’s existing external tariffs.

- Although pig meat imports are unlikely to change dramatically in the first few months after Brexit, it is expected that the market will adjust over time, perhaps to accommodate more competitively priced pork from outside the EU.

- Products exported to the EU face a more difficult situation, which may have an effect on profitability. There may be particular difficulty for those exporting sow carcases due to limited alternative markets.

Potential impact on farm profitability

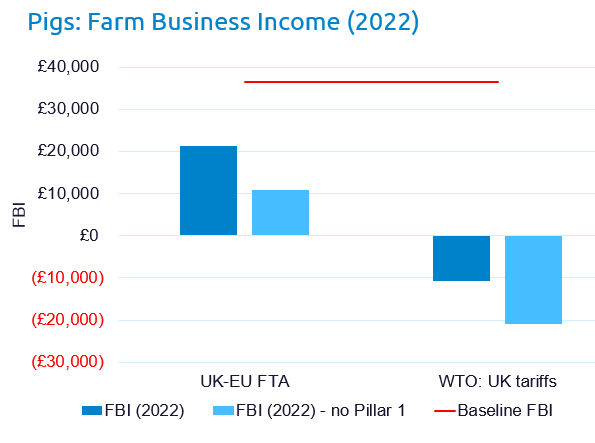

English pig farms could see their Farm Business Income (FBI) fall by 42% in 2022 even if there is a free trade deal with the EU.

Under a ‘no-deal’ Brexit scenario, where trade with the EU will be subject to WTO tariffs, FBIs could be over £10,000 in the red according to AHDB’s latest modelling work.