The UK pig breeding herd is forecast to grow slightly this year, while pigmeat production remains steady on 2024 levels, according to AHDB’s 2025 Pork Outlook.

The outlook, which can be viewed here, also forecasts continued pressure on export markets due to geopolitical tensions and a small decrease in overall pork poroduct sales volumes in 2025.

Pork production

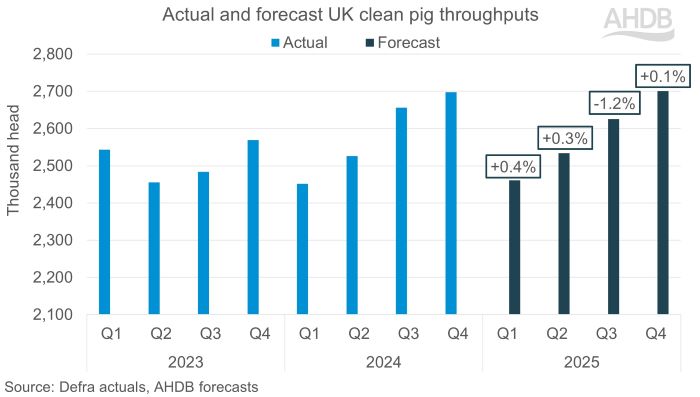

UK clean pig slaughter volumes are forecast to reach 10.32 million head in 2025, a slight decrease of 0.1% compared to 2024, while average carcase weights are expected to remain at around 90kg, in line with previous years.

This is expected to result in overall UK pigmeat production of 960,000 tonnes, just 0.1% below the 2024 figure. Small year-on-year growth is expected in Q1, Q2 and Q4, but Q3 is expected to see a 1.2% year-on-year decline due to the high production volumes in Q3 2024.

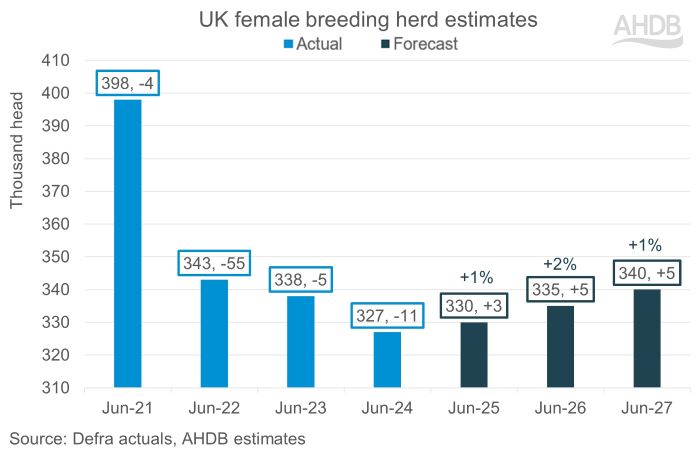

Despite improved industry sentiment, a number of producers continued to exit the industry through the first half of 2024. This ultimately led to a 3.1% decline in the UK female breeding herd at the Defra June census.

By contrast, H2 brought reports of on-farm investments, increasing demand at genetic firms and some intentions to up pig numbers. However, against this, the Autumn Budget created uncertainty, dampening sentiment at year end, which is being carried into this year.

On this basis, AHDB is forecasting a slight increase of just 1% in the UK female breeding herd to 330,000 in June 2025. It continues to anticipate only minor changes in the size of the breeding herd beyond this year, with numbers in 2027 forecast as similar to those recorded in 2023. This will be dependent on net margins remaining in a positive position, the outlook document adds.

Despite these relatively small changes, productivity improvements have been a driving force in the sector. AHDB’s quarterly estimated cost of production has seen a slight decrease over the course of 2024, but they have still contributed to positive industry sentiment and average net margins of £15 per head. However, ongoing uncertainty, including economic challenges and fluctuating costs, continues to impact producer confidence, especially as some producers exit the industry, the report cautions.

Trade

The outlook for trade in 2025 is mixed, with geopolitical tensions and market volatility continuing to affect UK exports. Export volumes are expected to be down by 1% year-on-year as lower shipments to the EU and USA outweigh gains in other markets.

The EU remains the UK’s most significant trading partner, with over 99% of UK pig meat imports and over 42% of exports coming from the region. However, demand from the EU is expected to decrease as EU consumption weakens.

Despite these challenges, there are brighter prospects in markets like Southeast Asia, where African Swine Fever (ASF) has impacted local production. The relisting of two UK processing sites for China and the potential for stronger trade ties with countries like South Korea could help offset weaker demand from traditional markets.

The outlook predicts that UK imports will bew up by 1% over the year, driven by price differential between UK and EU and robust demand in foodservice sector. It notes that consensus among traders is that FMD in Germany will cause minimal impact on UK imports, because buyers will source from elsewhere within the EU

Domestic demand

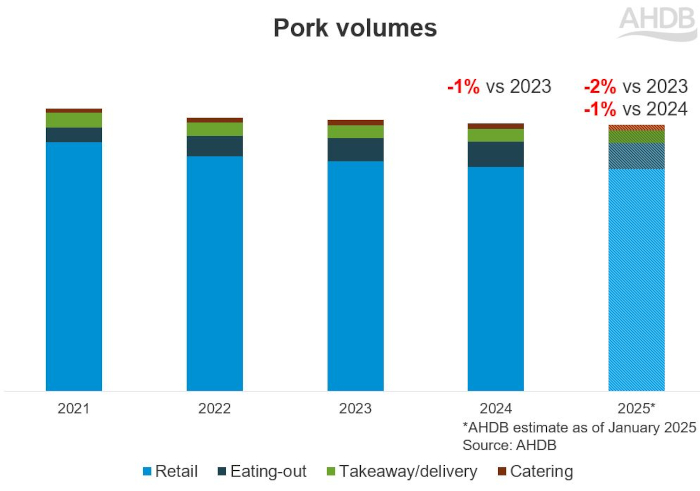

In 2024, UK retail demand for pork fell by 2.4% year-on-year according to Kantar (52 w/e 29 December 2024). The foodservice market performed better, with volumes up by 5.5% (AHDB estimates based on Kantar out-of-home data).

The outlook predicts Retail demand for pig meat is likely to remain under pressure in 2025 due to economic challenges and fluctuating consumer perceptions around the health credentials of pork.

However, the continued growth of the foodservice sector, particularly in dining out and on-the-go meal occasions, presents a valuable opportunity. Consumers are seeking affordable, convenient meals, with pork well-suited to quick, tasty options such as sandwiches and savoury pastries.

As a result, overall pork volumes for 2025 are expected to decrease by 1%, compared to 2024.

Vanessa Adamson, AHDB Retail & Consumer Insight Manager, said: “As we continue to face economic pressures, promoting the nutritional benefits and versatility of pork will be key in encouraging consumers to incorporate more pork into their meals. With increased interest in affordable meal options and a growing foodservice sector, there are significant opportunities to expand pork consumption, particularly through convenient products like sausages, burgers, and pre-prepared cuts.”

To enhance the outlook for pork consumption in 2025, industry players are urged to focus on communicating the health benefits of pork, such as its rich vitamin and protein content and promote versatile recipes, batch cooking ideas, and affordable meal options will help capture consumers’ interest. Premium cuts of pork should also be marketed as indulgent, treat-worthy options to appeal to those seeking high-quality, cost-effective dining experiences, the outlook adds.

Prices

Domestic pig prices will continue to face pressure from falling EU prices through Q1 2025, with the new year starting at a record price differential of 44p. Looking further ahead, prices could see some stability if no significant changes are seen in input costs, maintaining cost of production, the reports predicts.

It adds that global politics and trade dynamics will be a key influence on pricing trends in 2025, alongside the potential impact of disease outbreaks.

Freya Shuttleworth, AHDB senior analyst (livestock), said: “While the pork market faces challenges such as fluctuating export demand and rising geopolitical uncertainties, we are seeing signs of resilience.

“The continued growth of the foodservice sector and increasing consumer interest in value-driven cuts of pork offer potential areas for optimism. The industry’s focus must remain on meeting the evolving needs of consumers while maintaining high standards of welfare and sustainability.”