The pork market is set to remain to firm over the first half of 2017, as UK and EU supplies remain tight, although production could recover in the latter part of the year, according to AHDB.

In a generally positive outlook, the biggest cloud on the market horizon is that, while Chinese demand looks set to remain strong, increased production from the likes of the US, Brazil and Russia, could place downward pressure on the global market later this year.

For the first time, AHDB held annual its annual Outlook conference for the livestock sectors online, via a webinar broadcast live on Tuesday morning

Presenting the pork outlook, Vikki Campbell began by highlighting the extent of the UK price recovery in the latter half of the ‘roller coaster’ 2016.

“Prices started the year at the lowest levels since February 2000 and ended the year at over 150p/kg, more than 40p above the lowest level seen in March,” she said.

“Pig price has started to flatten in the first part of this year but it has not dropped as much as it did in the first quarter of 2016.”

She attributed the price increase to rising export demand, particularly to China, tightening of supplies and strong EU prices, although EU prices started to fall back towards the end of 2016.

Both imports and exports were up, although exports not by as much as expected given the weak pound in the second half of the year, with tight supplies and high domestic prices likely to have been factors in this.

Retail sales, over the whole of 2016, were down on 2015. However, over the last 12 weeks of 2016, while fresh and frozen sales were down, there was a slight year-on-year upturn in bacon, sausage and ham retail volumes sold, although prices were down, Ms Campbell added.

“Producers are now back in profit after losing money at the start of the year,” she said.

2017 outlook

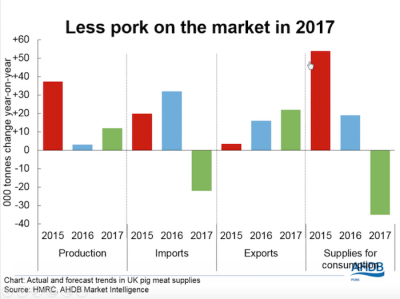

Production, initially strong at the start of 2016, fell back in the second half of 2016.

Moving onto the outlook for 2017, Ms Campbell predicted UK supplies would remain tight, despite official Defra figures suggesting rises in the sow herd.

She said various signs pointed to a declining breeding herd, including a decrease in breeding pig feed production and higher sow slaughterings at the beginning of 2017, despite lower sow prices. Breeding pig numbers are expected to ‘recover slightly’ in 2017.

All this means less pork on the market, at least in early 2017, she added.

“Therefore, with the assumed decline in the breeding herd, slaughterings, and therefore production, are forecast to fall in the first half of 2017, before recovering in the latter half of the year. Overall we would expect to see a small increase in production in 2017.”

Imports are forecast to fall back in 2017, especially if the pound remains weak against the Euro, alongside tightening EU supplies, although EU production is also expected to recover in the second half of 2017.

The weak pound should help to boost UK exports in 2017, although volumes could be pegged back by tightening domestic supplies.

Ms Campbell said: “Less pork available on the market in 2017, at least in the first half of the year, is expected we to support prices.”

Global production

She added: “Global production is expected to return to growth in 2017, with the US, Brazil and Russia continuing to increase production levels.”

“Increased US production has led to falling prices and this will have some effect on EU pork price and production levels as it will make EU pork less competitive on the global market.”

China will continue to have a huge impact on the global market but the picture remains unclear. Chinse demand is expected to remain strong, although falling prices towards the end of 2017, suggests there may be some easing off.

“While there may be some recovery in production there are very strict environment controls in China, which will inhibit largescale expansion,” she added.

Other factors that will have a big impact on the market, include the exchange rate and feed prices, which, if they continue to rise will impact on profitability.

Looking further forward, Brexit creates ‘massive uncertainty’. “These are very volatile times,” she said.