AHDB is forecasting only very limited recovery in both pork production and pig breeding numbers in 2024, despite much more favourable market conditions, as producers remain very cautious about expanding their herds.

Its 2024 Pork Outlook predicts that pigmeat production will grow by less than 1% this year, following an 11% year-on-year contraction in 2023, as clean pig slaughter fell to its lowest number in a decade on the back of the dramatic contraction in the breeding herd in 2022.

The pig industry returned to profitability over the last nine months of 2023, on the back of falling costs and rising prices, peaking at close to 216p/kg in August, with AHDB estimating average net margins over Q2, Q3 and Q4 of £22/pig, £25/pig and £19/pig respectively. This followed 10 successive quarters of negative margins, at the peak in excess of £50/pig, during which the industry is estimated to have lost more than £750 million.

Although the cost of key inputs, such as feed and fuel has eased, inflation has remained historically high and higher interest rates are likely to be negatively impacting working capital, AHDB noted.

Meanwhile, after strong growth in the first half of the year, UK pig prices have been on a steady downward trend since late summer, losing 14 since early August, following more dramatic downward, movement in the EU market. This has meant producer sentiment has remained uncertain, despite the prices remaining ahead of costs to provide healthy margins, AHDB said.

Supply

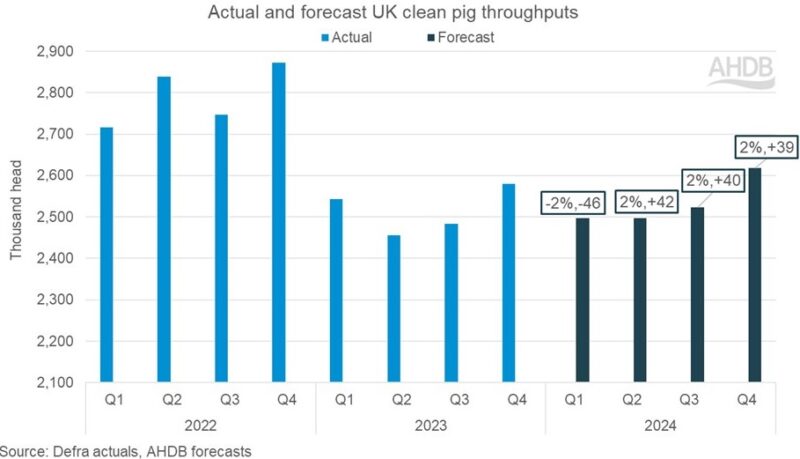

After a 10% decline in slaughterings in 2020 UK, pig supply remains tight supply for pigs and AHDB forecasts this will continue through the first half of 2024.

This is weighted towards Q1 with throughputs back year on year as many processors pulled pigs forward for kill at the back end of last year to meet Christmas demand. Although numbers in Q2 are predicted to marginally pick up, by 2% year on year, this is compared to a historic low and numbers forecast to be very similar to Q1.

A small uptick in throughputs, also around 2%, is predicted over the second half of 2024, as the gilts intended for first-time breeding recorded in the June 2023 census start farrowing.

Overall, AHDB forecasts that pig meat production in 2024 will grow marginally by 0.6% year on year to around 933,000 tonnes, driven by a 0.8% increase in the clean pig kill, totalling somewhere near 10.14 million head for the year. This forecast is based on average carcase weights of 89 kg, remaining in line with 2023.

AHDB identifies a number of ‘risks’, however, that could affect this forecast, including further outbreaks of Swine Dysentery, which continues to present challenges for the industry, and the ‘ever present’ threat of ASF crossing our borders.

Extreme weather events could also have a limiting impact. The summer heatwave of 2022 hampered the fertility of breeding stock, influencing production in the early part of 2023. It has been reported that adverse wet weather witnessed in recent months is taking its toll on farm productivity, especially on outdoor units, AHDB said.

Breeding herd

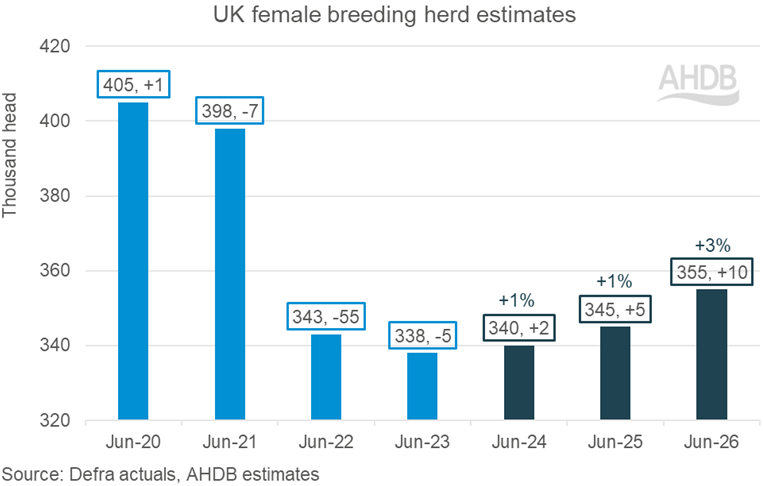

Despite improved farm margins, AHDB stresses that ‘hesitancy remains within industry, as the new year continues the theme of uncertainty’.

Easing pig prices, high inflation rates and an impending general election are limiting interest in large-scale investment, and instead of expanding herd sizes in 2024, AHDB expects to see a further focus on ‘herd rejuvenation’.

On this basis, it forecasting the breeding herd to only inch up by around 2% to around 340,000 head, followed by ‘subdued growth’ over the next couple of years as the market rebalances.

Trade

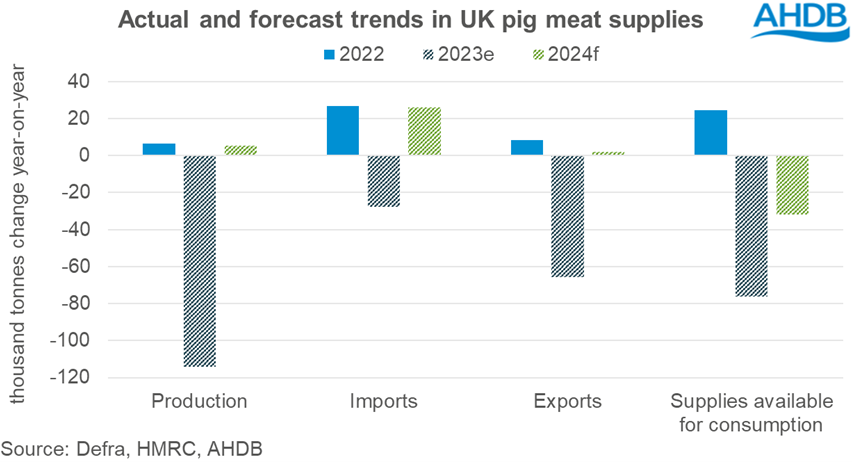

Imports of pig meat to the UK were down 2% year on year in volume terms in 2023 (Jan – Nov), although that doesn’t tell the full story.

In the first four months of the year, imported pig meat volumes were down on average 14% year on year following lowered domestic demand, tight EU availability and little differential between UK and EU pricing. However, since May monthly import volumes have been recording growth year on year, averaging 5%, driven by an increase in the price differential between UK and EU product alongside improved demand, especially in foodservice, which typically holds a greater weighting of non-British product.

AHDB anticipates this trend will continue into 2024, with imported volumes of pig meat ending the year up 3% on 2023.

With retail and foodservice demand forecast to fall, the continuing price differential between EU and UK product continues could see increased demand for cheaper cuts from the EU.

UK pigmeat exports were down 19% (Jan – Nov) last year on the back of lower production and higher pricing.

AHDB is forecasting a 1% increase in UK pig meat export volumes for 2024, based on a marginal increase in production, but volumes are expected to remain historically low.

Prices

AHDB expects the UK continue closely following movements in the EU market to maintain competitiveness. With supplies still running tight in both regions, prices may stabilise as the year progresses, but ultimately the balance of supply verses changes in demand throughout the year will dictate where pig prices sit, it said.

Demand

Total pork volumes declined by 1% in 2023, as growth in foodservice was not enough to balance for retail losses, according to AHDB/Kantar data for the 52 weeks ending December 24, 2023).

For 2024, AHDB expects overall pork volumes for 2024 to be down by 2% compared to 2023 and by 4% compared to 2019, as a result of eating-out not returning to pre-Covid levels and retail sales of meat suffering from the cost-of-living crisis.

Retail pork volumes are predicted to decline during 2024, as the price difference between pork and chicken is widening, which could see more shoppers switching out of the pork category than it gains from beef and lamb.

The out-of-home market for pork is also likely to struggle. Dine in, on-the-go and takeaways are expected to decline slightly year-on-year as consumers restrict spending and choose to take breakfast and lunch to the office from home.