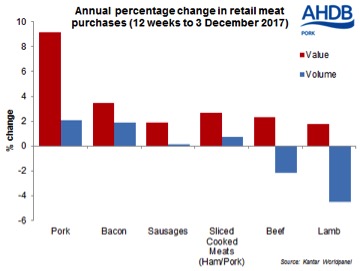

Pork was one of the only primary meat categories to record year-on-year growth in sales volumes during the 12 weeks to 3 December.

At over 2%, the year-on-year volume growth was smaller than in the previous 12-week period. Nonetheless, this was still well ahead of the marginal growth recorded for the whole of primary meat, fish and poultry. Within the pork category, particularly strong volume growth was recorded for mince (+27%) and leg joints (+25%). In addition, rising average unit prices meant the value of the pork market increased even further, gaining a notable 9% on year earlier levels.

Price inflation throughout the grocery market may be aiding consumer demand for pork at present. While pork prices have risen on the year, it is still a price competitive protein when compared to beef or lamb. With primary beef and lamb sales volumes during the same period down 2% and 5% respectively on the year, this might suggest consumers are switching towards pork as a cheaper red meat. The AHDB midweek meal campaign has also likely helped by raising the profile of pork for consumers.

Processed pig meat products also recorded a generally positive performance, with all categories recording increasing or stable sales volumes except for sausage rolls. Average prices were also generally higher, supporting the value of the market. In particular, the value of bacon sales increased by almost 4%, as both sales volumes and prices rose by 2%.

Looking forward, the next period will cover the key Christmas season, and it will be interesting to see whether pork has continued to excel. Gammon and pork performed well in Christmas 2016, perhaps influenced by shoppers switching to cheaper meats.