EU pork exports should reach a new high in 2020, based on strong trade demand from China and other parts of Asia affected by African swine fever, according to a new report by Rabobank

While the direct beneficiaries are the plants and storage facilities holding export licenses, the effects will be felt across the market, as prices remain at high levels, the bank’s agricultural analysts predict.

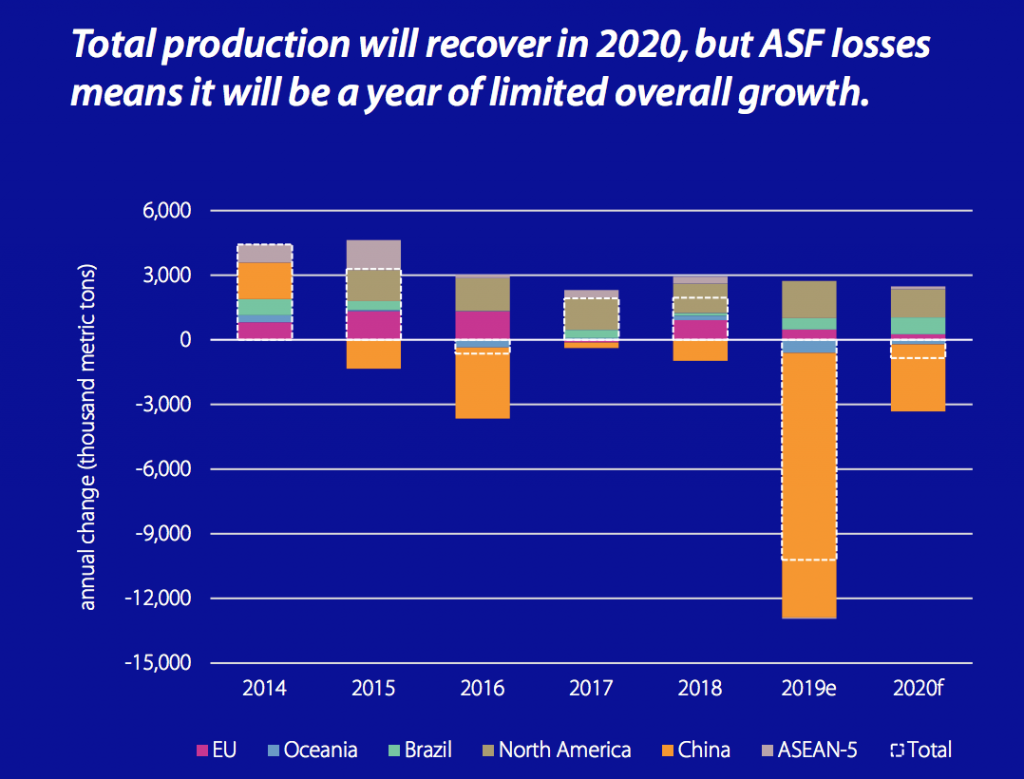

In its Global Animal Protein Outlook 2020, Rabobank says ASF ‘overwhelms the outlook for 2020 – as it has done during 2019 – and will pull down overall growth, as well as bring uncertainty to all markets’. “In short, in 2020, the global animal protein sector faces an uncertain world, which also offers opportunities for some.”

In particular, China’s production losses will exceed the growth in protein production in all other regions combined. Across species, aquaculture and poultry will lead production growth in 2020, while beef will be stable, and wild-catch seafood will decline again. All of these changes are minor compared with the production decline in pork.

ASF has already resulted in the loss of more than half of China’s pig herd in 2019. As a result, pork prices in Q4 2019 are more than twice as high as in the same period in 2018. The disease will continue to spread in China in 2020, and Rabobank expects pork production to decline further, by 10% to 15% from 2019 levels, given the low inventory of sows and the ongoing impact of the disease.

However, restocking is expected to begin in earnest in 2020, even though the risks of re-infection remain high. “Many farmers – especially large-scale farming companies – have ambitious plans to restock or invest in new farms,” the report says.

However, restocking is expected to begin in earnest in 2020, even though the risks of re-infection remain high. “Many farmers – especially large-scale farming companies – have ambitious plans to restock or invest in new farms,” the report says.

Rabobank expects investments in restocking and new farms to surge from 2020 onwards, resulting in a ‘slight recovery of the hog inventory in 2H 2020’. Nonetheless, pork imports will likely reach record levels in 2020.

“Given the high prices in China, the EU, Brazil, and Canada are expected to increase pork shipments to China in 2020. In addition, the tone in US-China trade talks suggests that China is willing to substantially increase pork imports from the US, subject to a broader agreement,” the report states.

“But pork trade is full of uncertainty, given rising demands from other parts of Asia where ASF has hit local production, and given the impact of politics on trade.”

While EU export demand is expected to reach record levels in 2020, Rabobank is forecasting a ‘modest supply response in Europe, with production up by 1.25% in 2020, after a marginal increase in 2019’. “This muted response will keep prices elevated in Europe in 2020,” the report says.

Meanwhile, the ASF situation in eastern Europe is a source of uncertainty for production. In addition, environmental policies, especially regarding manure management, are pressuring herds in Germany and the Netherlands, home to 24% of the total EU sow herd. Production expansion in Spain continues, but may slow slightly in 2020, the report adds.

Justin Sherrard, Global Strategist Animal Protein at RaboResearch Food & Agribusiness said the recovery from ASF will present obvious global opportunities in the animal protein market, which, in Rabobank’s view, will extend through the 2020s.

“Besides the impact of ASF, many trade disputes and issues are causing uncertainty for global animal protein, with the US-China trade war the most apparent – but not the only – trade uncertainty, he said.

“The ongoing rise of alternative proteins also adds to the uncertainty – even though Rabobank has a less bullish view of alternatives than others do.

“In our view, sustainability is just as important as other areas of uncertainty, as it will shape the growth of animal protein production and consumption through the 2020s.”

REGIONAL OUTLOOKS

North America: Rabobank expects production for all species to rise in 2020 – led by pork, followed by poultry, and finally beef. While domestic consumption will grow, exports will need to pick up to manage this production growth.

Brazil: Production growth is expected for all species in 2020. Export opportunities are the main driver, although domestic demand is also improving.

Europe: Poultry and pork production are set to rise, driven by export opportunities. Beef production is expected to decline, in response to soft consumption.

China: ASF dominates the outlook, with a further decline in pork production in 2020. Production will grow for all other species, given the pork shortage and prices at high levels.

South-East Asia: ASF is already affecting pork production and is expected to spread further in 2020, impacting production. Poultry production will again rise strongly in 2020, partly in response to ASF. Beef production remains flat, but imports are on the rise.

Australia & New Zealand: Tight livestock inventories in Australia will see beef production down and sheepmeat production stable in 2020, with firm prices for both. Rabobank expects New Zealand’s beef and sheepmeat production to rise, with favorable price levels.