UK pork exports and imports were both significantly down on 2022 levels during the first quarter of this year, as reduced supplies in the UK and Europe affect trade.

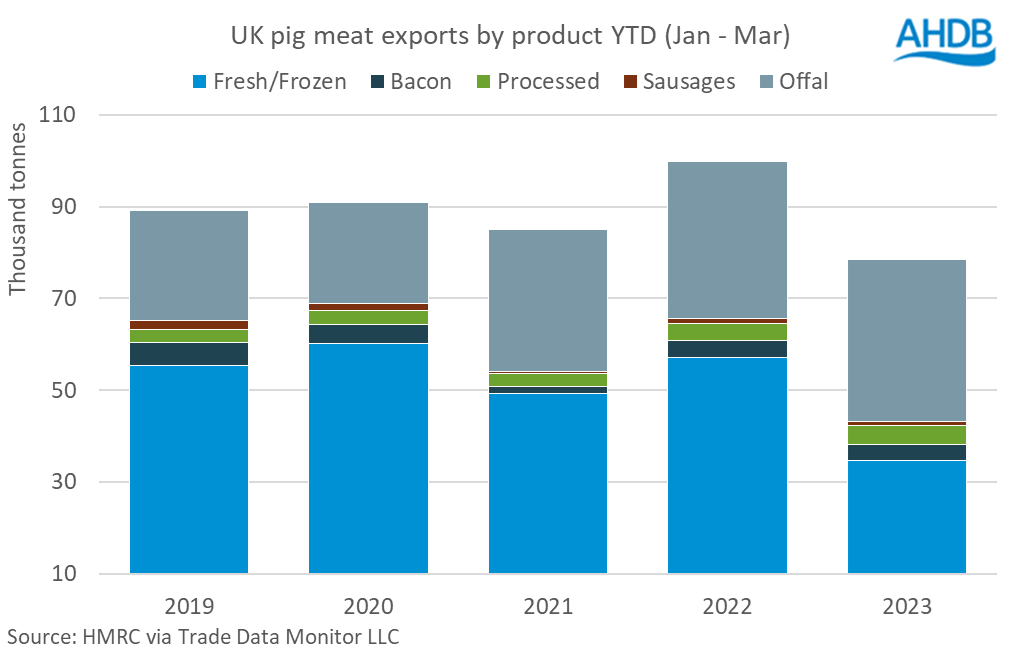

UK pigmeat exports were 21% down year-on-year during the first quarter of 2023, as the significant drop off in UK pig production resulted in reduced volumes available for export.

The 78,500 tonnes of pig meat (including offal) shipped during the period was the lowest volume exported in the past five years, with February (-13%) and March (-24%) volumes significantly behind the monthly five-year averages.

Fresh and frozen pork have seen the largest declines, down 39% year on year to 34,700t, while offal shipments grew 3% year on year to 35,300t, reducing the export market share of this category to 44%, down from 66% five years ago.

In contrast, shipments of offal have recorded a small increase with volumes up 3% year on year to 35,300t, with offal now taking the largest market share of exports at 45%, up from 24% 5 years ago. “Although offal remains a low value product, it is positive to see uptake in the market increase as ultimately this adds value to the whole pig carcase by aiding with carcase balance and reducing waste,” AHDB senior analyst Freya Shuttleworth said.

Shipments to all major trading partners were down, with EU and Philippines volumes down 10,900t and 4,600t respectively, and a smaller decline of 2,100t to China. However, some small gains were made in East Asia, including to Singapore, where volumes doubled year on year, and South Korea, up 36%, albeit from low bases.

Import volumes also down

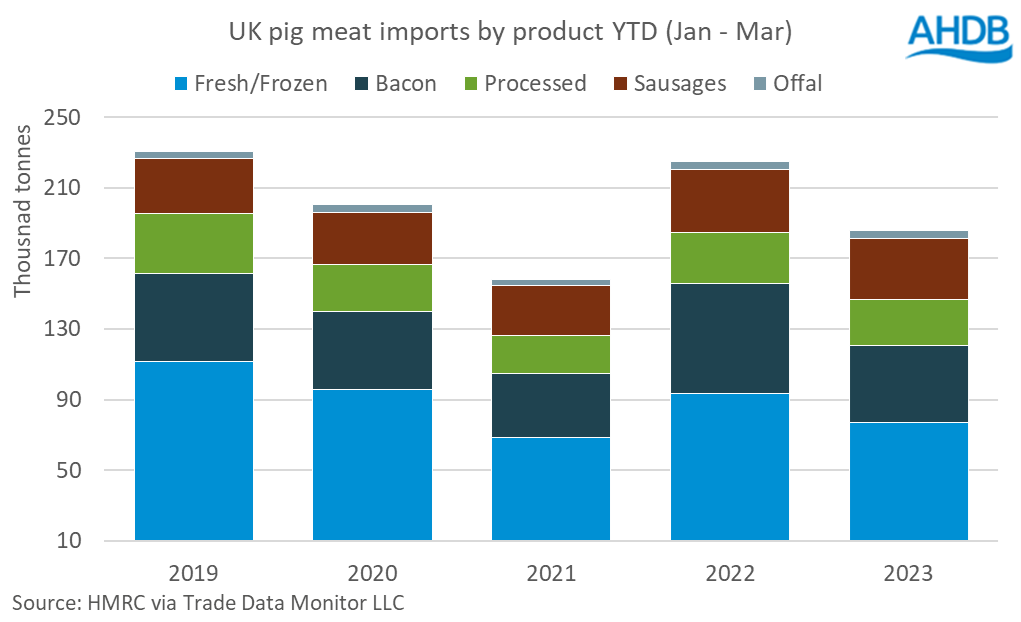

Tight domestic supplies have not led to higher import volumes, however, as inflationary pressures and the cost-of-living crisis weaken domestic demand and tight European pig supplies reduces product availability and price competitiveness.

UK pig meat imports declined by 17% year-on-year to 185,600t in Q1. All key product categories were lower, with bacon seeing the largest volume drop, down 29% to 43,900t and fresh and frozen pork volumes down 18% to 77,000t, although it retains the largest market share of imported product to the UK at 41%

However, imported sausages only recorded a small dip, down 3% year on year, totalling 34,300t, resulting in the category increasing its market share of UK imports to 18% in Q1.

“Inflation remains high, despite tentative signs of easing, driving a cost-of-living crisis for consumers which has lead to weakening domestic demand. The latest data (52 weeks ending May 15) shows volumes of pork purchased in the retail market have fallen by 3%.

“Added to this, the European pig market is also running on tight supplies, reducing product availability and price competitiveness,” Ms Shuttleworth added.