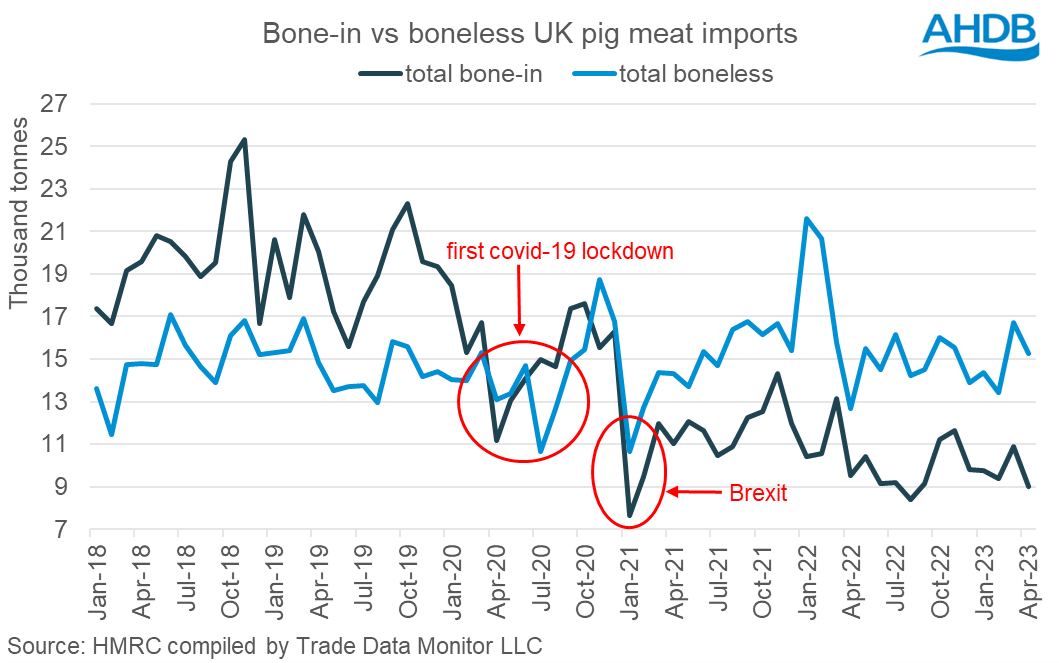

Data showing pig meat imports to the UK detail that, of the 25,300 tonnes imported in April, 60% (15,300) was boneless product, indicating a continued use of butchery capacity abroad.

For the year to date (January to April), the 102,200 tonnes of fresh/frozen pig meat imported to the UK consisted of 59,800 tonnes (58%) boneless and 39,000 (38%) bone-in. The swing towards an increase in the use of non-domestic butchery has been evident since the first Covid-19 lockdown in 2020 and comes as a result of the Brexit transition, according to AHDB senior analyst Freya Shuttleworth, with both events impacting UK butchery.

She said: “With UK pig meat production forecast to end the year down 15%, domestic processing capacity is currently facing an economic challenge rather than one of capacity; the restructuring we’re witnessing within the processing sector regrettably evidences this.”

Exports

In contrast, exports have not experienced the same change in product types, with bone-in pig meat remaining the dominant product. UK exports saw 10,100 tonnes of fresh/frozen pork in April and 53% (5,400 tonnes) was bone-in whilst only 13% (1,300 tonnes) was boneless product. For the year to date (January-April) 44,800 tonnes of fresh/frozen pork has been exported from the UK with 24,100 tonnes (54%) of this being bone-in and only 5,700 tonnes (13%) of bone-less.

Whilst exported product type remains unchanged, the destination of products has witnessed a changing landscape over the last five years. Outbreaks of ASF in China in 2018 led to a vastly increased import demand, with China overtaking the EU as the UK’s main export partner in 2021. EU demand increased in 2022 following the lifting of Covid-19 restrictions in Europe and the UK whilst China’s zero-Covid policy limited demand there, leading to the position for UK exports reversing again.

Ms Shuttleworth said: “This appears to be a trend that is continuing into 2023 despite the zero-Covid policy being lifted. Import demand in China has not bounced back to pre-pandemic volumes as domestic production has grown and a slow economic recovery leaves consumers feeling tight with their disposable incomes.”