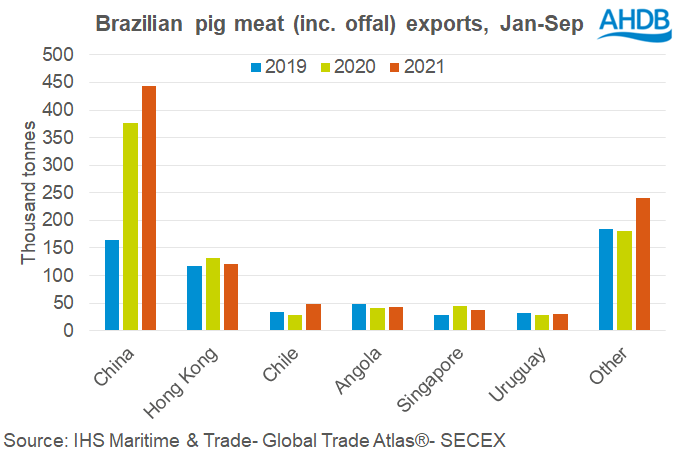

Brazilian pig meat exports (including offal) during the first three quarters of 2021 were 15% higher than in the same period of 2020, totalling 962,000 tonnes.

Whilst this represents a a slowdown compared to the first half of the year, when shipments were up by 19%, the slow down in growth has largely been due to stagnating exports to China, according to AHDB analyst Bethan Wilkins.

Brazilian shipments to China in the first half of 2021 were 28% higher than during the equivalent period in 2020. By the third quarter however, exports were level with a year earlier as China’s import demand dropped in recent months, with increased domestic supplies weakening prices.

Outside of China, several other markets have played a central role for the ongoing growth in Brazilian export volumes, including the Philippines, which has taken more than three times as much Brazilian pig meat than during the same period last year.

Chile has also been an important growth market this year, particularly in the first half when volumes were almost double 2020 levels. Other smaller, but notable growth markets include Venezuela and Argentina.

Ms Wilkins said that the widespread success of Brazilian exports this year has no-doubt been aided by the devaluation of the Brazilian Real.

“The total value of exports for the year to September was BR11.6bn, a 30% increase compared to the year before,” she explained. “The increase is smaller in both US dollars (+24%) and Euros (+17%). The strong relative price-competitiveness of Brazilian exports represents a challenge for other global exporters, including the UK, as we compete for buyers on the global pork market.”