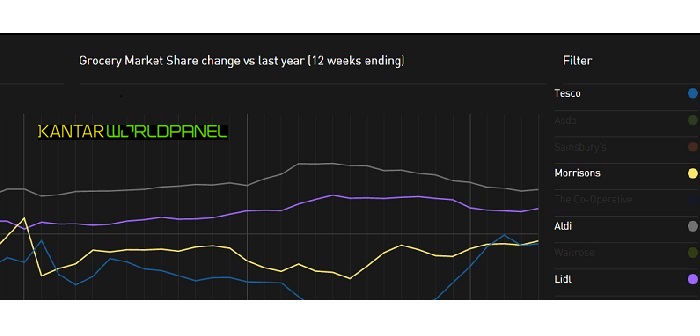

The supermarket chain, Morrisons, has returned to growth for the first time since December 2013 according to the latest market share figures from Kantar Worldpanel, covering the 12 weeks to May 24.

Morrisons, who have a 100% British fresh pork rating on the latest BPEX porkwatch list, was the only one of the big four retailers to see increased sales in the Kantar Worldpanel report period, although its market share remained unchanged at 10.9%.

“A committed core of loyal Morrisons’ consumers is responding positively to recent initiatives, and business has been boosted by online sales,” said Kantar Worldpanel’s head of retail and consumer insight, Fraser McKevitt, adding that this is still “only the first step in any future recovery”.

The market share figures also showed Sainsbury’s having held its share at 16.5%, despite sales falling by 0.3%, while Tesco sales decreased by 1.3%, with its market share falling to 28.6%. Asda sales, meanwhile, were down by 2.4% with lower prices charged at the till “not sufficiently offset by increased footfall”.

“All of the major supermarkets are finding growth difficult as prices have been declining since September 2014,” said Mr McKevitt. “Yet, while like-for-like groceries are 1.9% cheaper than this time last year, this is not as steep a fall as last month, when prices were down by 2.1%. This means that if current trends continue, prices will once again start rising by the end of the year.”

The growth of discounters, Lidl, continues, however, rising to a new record high market share of 3.9%.

“Lidl’s growth has been fuelled by a combination of more consumers visiting the stores and the average basket containing more items, demonstrating a consumer willingness to move their bigger shopping trips to the so called ‘discounters’,” said Mr McKevitt. “Aldi also grew sales by 15.7%, taking its share to 5.4% of the market.”