UK retailers stocked more British pork their shelves in January than they did two months earlier, according to the latest AHDB Porkwatch survey.

However, the results were mixed across the 11 retailers surveyed, prompting NPA chief executive Zoe Davies to warn those at the bottom end of the scale not to let short-termism jeopardise the supply chain’s long-term Brexit future.

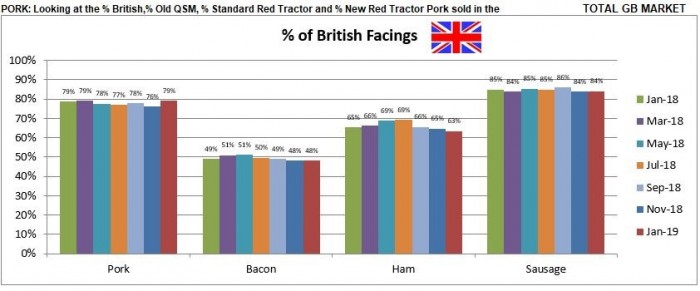

The January audit showed 79% of fresh and frozen pork on display across the 11 retailers was British, compared with 76% in November and marginally up on a year ago.

You can see all the figures from the January survey here

All the retailers surveyed were found to be stocking 100% British pork, except Asda (42%), Tesco (64%, which was up 19% on November and 4% versus a year ago) and Iceland (46%).

There was little movement compared with November in the other categories, with bacon and sausage unchanged at 48% and 84% respectively and ham down 2 percentage points at 63%. All three categories were down on January 2018 in terms of British ‘facings’.

Marks & Spencer, Waitrose and the Co-op continued to be the leading supporters of British pork products in terms of the percentages of British on display. They all stocked 100% British pork and bacon, with M&S and Waitrose also 100% on sausage.

At the other end of the scale, Iceland posted the lowest single figure, of just 16% for British bacon, although it fared better in other categories.

Of the larger supermarkets, Asda continued to post the lowest figures, particularly for pork (42%), bacon (28%) and ham (26%), well down on November and a year ago, with sausage at 81%.

Sainsburys posted the best figures among the ‘big 4’, particularly for pork (100%), ham (95%) and sausage (84%), with bacon at 44%. Aldi also demonstrated good support for British pork products, with pork (100%), ham (81%) and sausage (95%), and bacon also at 44%.

Dr Davies said it was reassuring to see the majority of retailers continuing to support high quality British pork, particularly in the fresh pork category at a time when things are particularly tough out there.

“Clearly some retailers are still in Brexit denial as they are failing to make any real attempt to secure British supply. If they fail to support British farms now, that supply simply won’t be there in future when other options look less attractive,” she said.