A new “pig industry in crisis” report has been issued today by AHDB Pork, along with the warning that “much of the findings make for grim reading”.

The report reveals that the price farmers and pig producers are receiving for their pigs has fallen by a third in a little over two years with AHDB Pork adding that “should this trend continue it is feared many will be forced to leave the industry”.

Produced by the organisation’s market intelligence team, the report aims to provide an overview of the pig industry in the UK and a round-up of the state of the market.

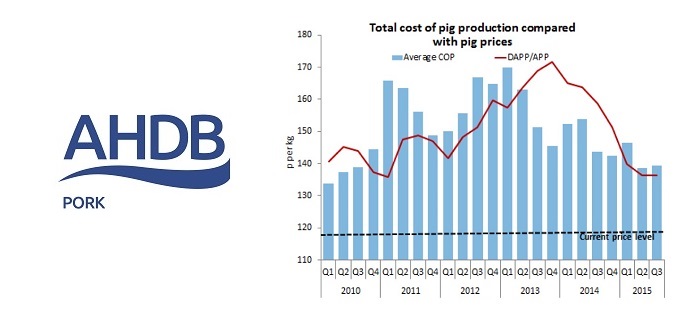

“Since late 2013, the average pig price has fallen steadily, with pigs losing a third of their value in that time,” it is stated. “Price falls have accelerated in the past 12 weeks, losing 13p/kg (around £11 per head).

“As a result, many pig producers are now losing money and there is an increasing risk some will decide to leave the industry, affecting the level of UK pork available to the market.”

AHDB Pork market specialist manager, Stephen Howarth, added: “The report has been produced against a backdrop where production continues to rise as efficiency and productivity improve and record weights are being seen.

“This all leads to more pigmeat on the market. At the same time, demand for pork has dropped, even though the price is falling. UK pork is having to battle hard against cheaper EU imports, exacerbated by the weakness of the euro against sterling and a supply glut on the continent due to increased production and closure of trading routes to major export partners.”

Key findings include:

- Retail purchases of pork have been decreasing, despite falling prices. Consumers are increasingly switching to more convenience based foods, where pork does not feature strongly, as well as to chicken, and the image of fresh pork is becoming dated and jaded, a trend which the current Pulled Pork advertising campaign aims to reverse.

- Along with higher production, this has contributed to the downward pressures on pig prices – currently at a near eight-year low; in real terms, prices are the lowest since 2000.

- UK pork has had to compete with cheap European imports, with a continental supply glut, accompanied by a weak euro.

- This has further driven down the value of UK pork – although export volumes have grown slightly, especially with global export partners such as China.

- There is little sign as yet of any herd rationalisation in the UK, as the falling cost of production helped to cushion some of the price falls in 2015.

- Pig prices are now at a level which is lower than average producer cash costs, so we are likely to start to see producers leaving the market and breeding herds becoming rationalised.