Pigmeat imports from Poland are steadily increasing their presence on the UK market, a trends which seems set to continue, according to AHDB Pork.

“There has been a steady growth for processed products, notably canned hams, following Poland’s accession to the EU in 2004, while imports of fresh pork have started to take off,” said AHDB Pork in an extended analysis of the development.

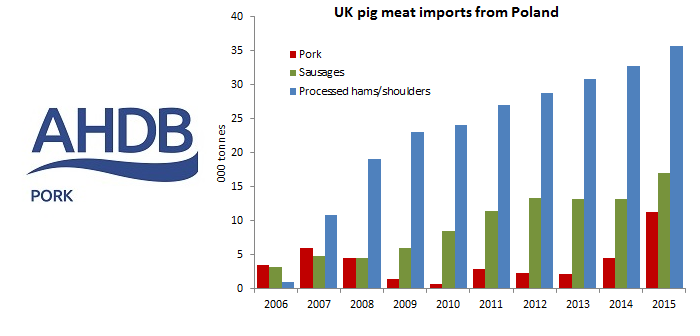

Imports of processed hams and shoulders amounted to 36,000 tonnes in 2015. That means that since 2007, when the trade started to develop, volumes have more than trebled. Sausages also account for a significant quantity of imports, reaching 17,000 tonnes in 2015.

“Such product is generally branded and sold not only through Polish retail outlets but increasingly through mainstream outlets,” said AHDB Pork. “For example, the ASDA website includes ‘Authentic Polish Foods’, with a wide range of processed pigmeat products. Other multiples also sell a range of Polish processed meats.

“The number of UK residents born in Poland now amounts to 850,000, although the true figure for the Polish population will be higher, as families will have children born in the UK. Therefore, this accounts for a growing market for those customers seeking indigenous foodstuffs from the country in which they were born.”

All of which means that UK imports of fresh/frozen Polish pork more than doubled in 2015, reaching 11,300 tonnes. This compares with Polish imports of only 750 tonnes as recently as 2010.

“This pork is destined for secondary processing and mainly consists of chilled boneless cuts and bellies,” said AHDB Pork. “However, one major Polish meat processor, ZM Wierzejki, which has 170 retail outlets in Poland, opened its first shop in East Acton, West London, at the end of last year. Its statements also indicate plans to open a dozen new stores and attract not just Polish consumers.

“The meat-processing sector in Poland is sourcing its raw material from both domestic producers and imported product, some of which is subsequently re-exported. Major investment is taking place, including by Scandinavian companies, some of which has yet to come on stream. According to IFIP in France, much of this investment is geared towards supplying the UK market and the premium prices that it can offer. This includes investment in cutting plants and further processing facilities.”

Although Poland is still not yet a major player on the UK market, with a market share of all pigmeat imports of just 7%, AHDB Pork says the country is certainly a major player on the EU market.

“Even if its pigmeat production (in Poland) is no longer expanding, its low labour rates and increased investment in processing is sucking in more imported product for subsequent re-export, including to the UK,” it said. “Volumes of processed products have been rising year-on-year, and increasing investment would suggest that this is set to continue.”