The reduced size of the EU pig breeding herd recorded in the year to June 2016 is expected to lead to some cut in supplies over the coming months but won’t necessarily do much for prices, according to AHDB Pork.

Publishing its review of the latest meeting of the EU’s pigmeat forecasts working group, AHDB Pork points to “uncertainty about future export prospects and subdued EU consumer demand” as reasons for caution concerning 2017 pigmeat price projections.

“How the market develops as we move through next year will depend in large part on export demand,” it said, adding that the EU market this year has been supported by booming exports to China with the EU being well placed to respond to increased Chinese demand for imports.

“EU pork was competitively priced and the Chinese ban on Ractopamine limited imports from the US. However, with more hormone-free production across the Atlantic and falling US prices, EU exporters may not get such an easy ride next year, even if Chinese demand doesn’t reduce.”

The working group meeting also looked at EU consumer demand, reaching the view that this remains a challenge.

“Most major markets are seeing falling consumption, while sales of fresh pork are particularly struggling,” said AHDB Pork. “Processed products are generally faring better, due to a better fit with busy modern lifestyles, but often deliver lower value to the industry.

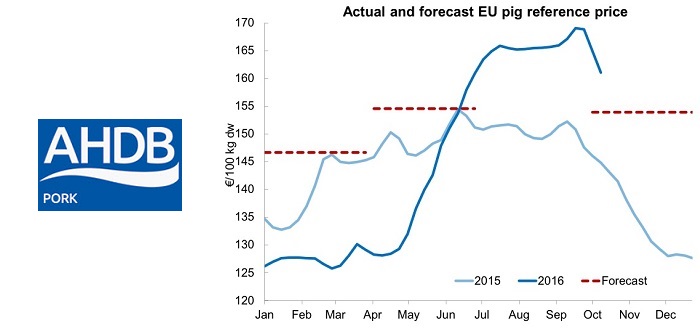

“Based on these concerns, forecasts suggest that seasonal price gains may be more modest next year than in 2016. Despite starting the year well above this year’s level, therefore, prices are not expected to reach the same peak and are forecast to fall below 2016 levels in the second half of the year.”

While adding that these forecasts still suggest a “reasonable year” is in view for EU producers, AHDB Pork said there appears to be little prospect of a return to the high prices recorded in 2013 and early 2014.

“Of course, how this impacts on the UK market will depend, among other things, on the pound-euro exchange rate,” it concluded. “If the pound remains weak or weakens further, in fact, a firm EU market could still give support to UK prices.”