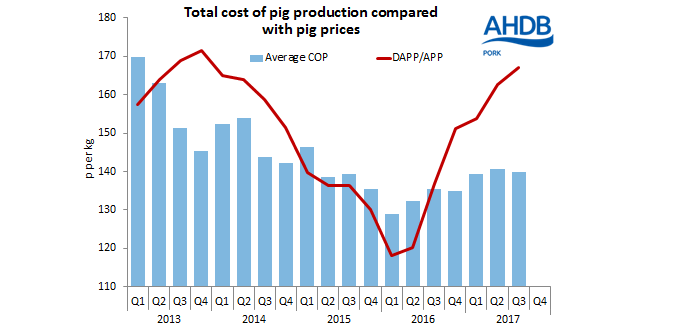

Pig producer net margins reached 27p/kg in Q3 2017, the highest since records began in 2009, according to new figures from AHDB Pork, who say the increase was due to a combination of rising pig prices and falling production costs.

“The average cost of production between July and September was estimated at 140p/kg, around a penny less than in the quarter before,” said AHDB Pork. “This followed on from a slight decline in feed costs, with other input costs remaining broadly the same. Despite the small quarter-on-quarter decline, feed costs were still 5p/kg up on the same period last year.”

With production costs only declining modestly, however, it was rising pig prices that really elevated producer margins.

The EU-spec APP averaged 167p/kg during the quarter, the highest since the series began in 2014. This means that producers have now been profitable for 15 consecutive months.

The story isn’t all positive, however, due to pig prices having fallen in recent weeks, leading to a suggestion that producer margins are now “likely to tighten”.

“The APP during Q4 averaged around 10p less than in the previous quarter at 157p/kg,” said AHDB Pork.

“The first quarter is traditionally a more difficult period for pig prices. However, over the past five years estimated producer net margins have averaged only 1p/kg. As such, in a long-term context margins are still likely to be more reasonable in the short term, even if pig prices continue a steady decline, highlighting the need for producers to assess the profitability of their enterprises on a multi-year basis.”