The differing short term impacts of the “Brexit” result have been analysed by AHDB Pork, highlighting potential exchange rate benefits for both pigmeat exports and imports while noting that many inputs, such as fuel, feed and fertiliser, may become more expensive in sterling terms.

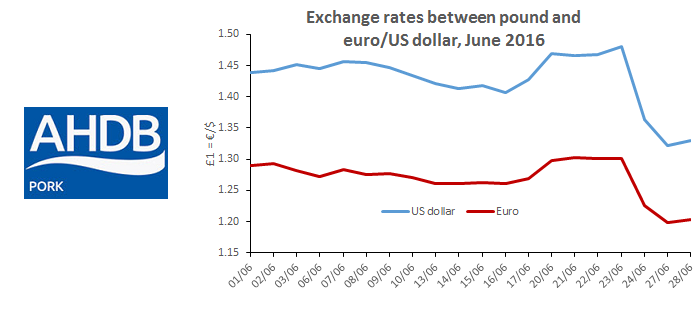

“Once the result of the referendum was clear, one of the first effects was seen in the UK currency,” said AHDB Pork, adding that the value of the pound fell sharply against other currencies during the day after the result, with further falls being seen at the beginning of last week.

“As of June 29, £1 bought €1.21, down 10 cents since immediately before the referendum result and the lowest level in over two years. Against the US dollar, the pound hit its lowest level since 1985, at $1.32.”

This was bound to have an immediate impact on the pigmeat sector, given that the UK pig price is closely related to the exchange rate between the pound and the euro, due to the fact that approximately 60% of pigmeat consumed in the UK is imported, mostly from the Eurozone.

The decline in the value of the pound will therefore have made imported pigmeat from the EU less competitive on the UK market, pointed out AHDB Pork, adding that according to the exchange rate as it stood on June 23, the EU average reference price was equivalent to around 116p/kg. A week later, the currency rate change meant the same reference price was equal to about 125p/kg.

“The UK’s trade relationship with the EU will remain as it was before the referendum until the terms of the UK’s exit from the EU are agreed over the next two years,” said AHDB Pork. “As a result, free trade with our largest market can be expected (to continue) in the short term.”

That seems to promise all-round UK pigmeat trading gains. A weaker currency, for example, may limit imports by making UK products more competitive while the same weaker pound could make UK pigmeat more price competitive on export markets.

“However,” added AHDB Pork, “it is not only meat imports that will be impacted in the short term as many inputs, such as fuel, feed and fertiliser, may also be more expensive in sterling terms.”

AHDB Pork also urged producers to note that currency is only one factor within a range of market drivers which will affect supply and demand in the future, influencing market movements for both outputs and inputs.

“It will also be important to track the impact of economic and political uncertainty on consumer behaviour and demand,” it added, promising that AHDB will continue to deliver more information and analysis on the “evolving situation” from the perspective of how the pork industry may be affected in the coming months and years.