Pig producers in the US have been warned to expect the country’s meat market to develop into a “more challenging profit environment” over the next two years.

That’s one of the key messages contained in a US-based chicken, cows and pigs report published by Rabobank, and delivered at a time when US pork packing capacity is set for a significant expansion, timed for completion by the end of next year.

Forecasting a US protein production growth of 2.5% a year through to late 2018 (down from 3% in 2015), the Dutch-based bank said it expected beef to be the largest contributor to future growth, relative to pork and poultry.

“The expected challenges to profitability in the US animal protein sector stem from the combination of a rebuilding of the US cattle herd and the construction and expansion of plant capacity in both the pork and poultry sectors,” said Rabobank, noting that production growth in 2015 had left both the US pork and poultry sectors at near peak-capacity utilisation during the summer and late autumn periods.

“As a result, the pork sector is currently in the construction phase of four new pork plants, which would add 6-7% to US packing capacity by the end of 2017, and another 2%, dependent on the timing of a planned fifth plant.

“This is the largest increase in capacity in more than 20 years, and the signs are that at least four of the five plants will be built. What may be even more significant is that two, if not three, of the larger plants will have the ability to run a second shift, which would double their capacity and bring the total increase to 14-15%.”

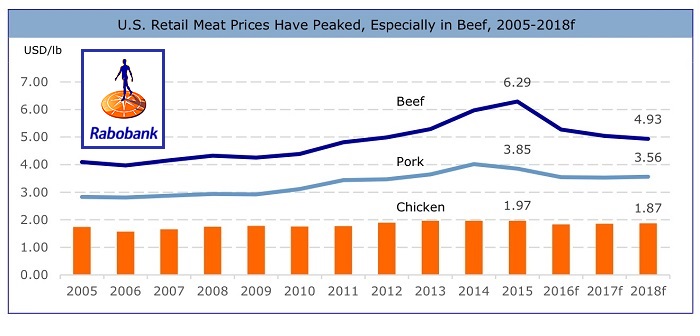

In the face of such capacity expansion, however, Rabobank’s market expectation is that US retail meat prices will decline by 14% percent by 2018, with beef taking the biggest hit (falling 22%), followed by pork (down 7%) and chicken (down 5%).

At the end of that cycle, nevertheless, the bank’s conclusion is that there will still be late-2018 opportunities for those producers with the capital and foresight to take advantage of them.