Global hog producers are facing a challenging outlook, According to the latest pork report from Rabobank, with structural and transitional supply chain disruptions and tight global grain stocks raising the cost of production, as a growing hog supply is driving prices lower.

“The most severe impact is being felt in markets that were slow to recover from the pandemic or have struggled with trade disruption or disease,” commented Christine McCracken, senior analyst for animal protein at Rabobank.

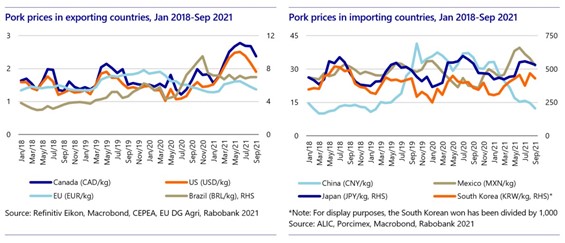

The report shows that global hog prices have moved sharply lower as the global recovery in production has outpaced the rebounding demand. Rabobank predicts that herd growth in 2022 will slow due to the rapid decline in prices and resulting producer losses.

Labour constraints in some markets and cost inflation are expected to pressure production margins, with the pass-through of these costs to consumers likely to weigh on demand, further dampening consumption.

The report noted that limited pricing power and higher costs are also pressuring hog production returns, resulting in scaled-back growth plans in many markets. This follows a strong year for pork production in 2021, with total year-on-year gains expected to be 3.4%.

Tight global inventories of corn and soybeans, together with the recent surge in fertilizer and chemical costs, are expected to drive increased volatility in feed markets in 2022.

Ms McCracken noted that new cases of traditional health challenges like PRRS and PEDv drove larger-than-expected losses in 2021, but predicted that productivity will improve as the herd builds immunity.

“African swine fever (ASF) also remains an issue in many parts of the world, with active cases in China, the Philippines, South Korea, Vietnam, and Europe,” says McCracken, as in recent weeks the virus has reappeared in a commercial herd in Russia and was discovered in the Americas, with new cases in the Dominican Republic and Haiti.

These new cases, while not economically meaningful, create new risks for regional production. “ASF not only threatens the survivability of the herd, it also typically eliminates trade, which can be equally devastating,” adds McCracken.

She also warned that high-cost pork will face the greatest resistance at foodservice, as the industry is already struggling with higher labour and food costs.

“Ultimately, consumers will likely trade down to lower-cost cuts and other proteins or will reduce pork consumption altogether. This slowdown in expected demand is likely to drive a wider imbalance with supply, ultimately slowing trade and driving prices lower,” she said, adding however, that larger pork volumes are still expected to be absorbed as the global market emerges from the pandemic, even as higher pork prices will limit consumption.