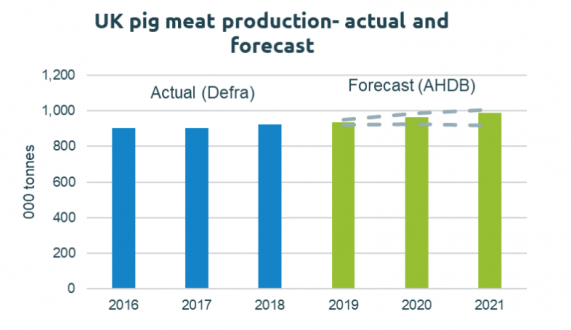

UK pig production is expected to increase by 1% in 2019 to 935,000 tonnes, but rising export demand should support higher prices, according to AHDB’s latest market outlook.

The modest production boost is expected to come from a 1% increase in slaughterings to 10.7 million pigs, with sow productivity expected to recover after a difficult year and average carcase weights forecast to rise. Growth will be biased towards the end of the year and is likely to continue into 2020.

The breeding herd appears to have been broadly stable towards the end of 2018, but some growth is anticipated in 2019. The latest Defra census results show stability in the breeding herd in December 2018, while sow slaughter levels have also been fairly flat recently.

Despite the current poor financial position of producers, opportunities from Chinese import demand are now expected to encourage growth, particularly in the integrated outdoor sector. This sentiment allies with anecdotal industry reports, AHDB said.

The combination of a rise in carcase weights and slight growth in slaughter levels means UK pig meat production is set to increase by just over 1% this year, reaching 935,400 tonnes. Further increases in productivity and carcase weights will see production increasing by 2-3% in 2020 and 2021, AHDB predicts.

As has been well-documented, there is currently a lot of frustration across the sector at the lack of movement in pig prices at a time when prices are soaring globally on the back of higher Chinese demand.

GB finished pig prices fell in quarter one, with the EU-spec SPP averaging 138.10p/kg. This was 5.59p lower than the previous quarter. Prices did start to pick up in March, however the uplift has been fairly subdued considering the level of increase on the continent. By week ended April 20, the SPP still only stood at 138.67p/kg. Prices have therefore remained over 6p below year earlier levels.

Brexit stockpiling activity is thought to have delayed rising GB prices. EU EU pig prices increased to average €137.34/100kg in quarter one. This was largely due to increased import demand from China towards the end of March. Prices then increased rapidly into April and averaged €168.

However, the China effect is expected to feed through to UK prices as the year progresses.

Imports are expected to fall by 1% this year to just over 1m tonnes, with rising UK production and tight EU supplies and rising EU exports to China.

China-driven demand could see a 5% increase in export volumes to a new high of 279,000 tonnes, following export growth last year.

“Chinese import demand should draw more lower-value pork from the UK and EU markets this year,” the outlook document predicted.

“As UK production is only expected to rise modestly, this could leave less pig meat available for consumption here. This should help improve carcase values, and support prices at farmgate level.

“Of course, demand levels within the UK will also be important. Recent consumer trends suggest demand is likely to remain broadly stable.

Brexit uncertainty continues to cloud the long-term picture and there is scope for market conditions to alter considerably, even before the end of this year, depending on how it pans out.