Defra’s December livestock census for England shows significant growth of both the overall pig herd and the breeding herd.

The overall herd was up by 8.7% on December 2023 to 3.6 million head, which equates to 300,000 more pigs on England’s farms at the end of 2024 than a year earlier. The increase took overall herd size closer to the 2022 figure of 3.7m head, but it remains well below the December 2021 figure of nearly 4.1m head.

The increase was driven by driven by an 8.5% rise in the number of fattening pigs, which account for 91% of all pigs, to close to 3.3m head. There was no change in small piglet numbers, but there was an eye-catching 26% leap in weaner numbers (up to 29kg) to 958,000 head. Fattening pigs over 29kg were up by 3.2% year on year to nearly 1.9m head.

The extra pigs on farm ties in with separate Defra 2024 production figures. Improved on-farm productivity drove clean pig slaughter numbers up by 2.8% year on year to 10.33m head in 2024, despite a further contraction of the breeding herd, as shown in the June 2024 census.

The growth particularly pronounced in the second half of the year – Q3 and Q4 were both significantly ahead of 2023 levels. In December, for example, slaugherings were 10% higher than a year earlier.

Breeding herd growth

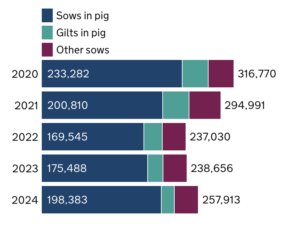

Even more significant is the 8.1% increase in the English female breeding herd to 258,000 in December 2024, equating to 19,000 more sows.

This increase was driven by a 13% rise in the number of sows in pig to 198,000 head and a 1.2% rise in ‘other sows’, including suckling and dry sows, to 39,000 head, which more than offset a 16% fall in gilts in pig to below 21,000 head, compared with December 2023.

Perhaps most encouraging in terms of future herd growth prospects, the number of gilts not yet in pig was up by 22% to more than 66,000 head. The number of boars in service was up 5.3% to 8,400 head.

Comparison with the June census is difficult and can be misleading – the December figures are generally markedly lower than the June data.

In this case, the overall pig herd is just 1.9% below the June figure (the December-June 2023 difference was 8%), and the December 2024 breeding herd was actually 2.6% above the June 2024 figure, the first time this has happened since December 2008.

This data is for England only, so is not resprentative of the UK, and there is always margin for error in the pig datasets, given the varied nature of pig ownership.

But, at face value, they appear to be an early indicator that the sector is looking to grow again, albeit it is unclear how much of it this currently coming from the corporate sector, versus the independent producers.